Services

Institutional investors profit from Picard Angst’s independent platform for investment solutions as well as from our comprehensive services. Our Client Advisory assists investors with complex investment decisions. Asset Management looks after and manages large assets on a mandate basis. And our systematic Financial Engineering develops individual products and solutions.

Research and Strategy Development. Getty Images

Client Advisory

Picard Angst assists institutional investors with identifying opportunities and avoiding risks in complex situations. We do not sell any products; we listen and construct individual, customised scenarios. Our independence, proven expertise and absolute reliability make us a long-term partner with a singular track record of success.

Services

- Analysis, research, benchmarking

- Strategy development, scenarios

- Networking, partnerships

- Compliance, documentation

Your benefits

- Your own personal contact

- Large partner network

- Many years of experience

- Independence

Your contacts

Daniel Gerber

Head of Market Switzerland & Chief Sustainability Officer

+

Christoph Beck

Senior Client Advisor Market Switzerland

+

Bora Sentürk

Senior Client Advisor Market Switzerland

+

Murielle Marascio

Client Advisor Market Switzerland

+

Analysts meeting in glass conference room. Getty Images

Asset Management

We look after and manage large institutional assets on a mandate basis. Our aim is to sustainably achieve attractive, risk-adjusted returns. Our approach is systematic and, thanks to its evidence and rules-based process, it ensures high transparency while preventing behavioural risks.

Services

- Individual asset-management mandates

- Asset allocation steering

- Risk scaling

- Timing rebalancing decisions

Your benefits

- Evidence and rules-based approach

- Systematic management of portfolios

- Prospective, cyclical risk management

- Identification of market dynamics

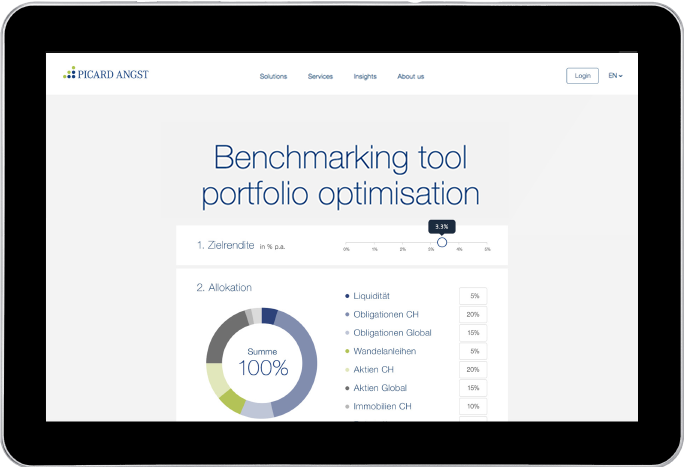

Portfolio optimisation

Test out how you can improve your portfolio’s profit/risk profile.

In collaboration with OpenMetrics

Your contacts

Dr. David-Michael Lincke

Head of Asset & Portfolio Management

+

Sivapriya Kumar

Senior Portfolio Manager

+

Shiyin Li

Portfolio Manager

+

Benchmarking and pitching. Getty Images

Financial Engineering

Picard Angst uses systematic Financial Engineering when it develops individual products, strategies and solutions. Based on a quantitative, rules-based approach and paired with a disciplined investment process, it sustainably achieves comparative advantages. Thanks to our independence, our clients always profit from rigorous best-in-class selection.

Services

- Development of individual products and solutions

- Research, documentation and reports

- Pricing, pitching, tax aspects

- Product and partner selection

Your benefits

- Proven expertise

- High placement power

- Flexible product design

- Over 30 issuers

Your contacts

Bora Sentürk

Senior Client Advisor Market Switzerland

+

Koray Yilmaz

Senior Financial Engineer

+