Biotechnologists are optimising agricultural plants by researching cress. GETTY IMAGES

‘The Food Revolution’ is in full swing

With ’The Food Revolution’ Picard Angst offers access to an exciting investment topic. Invest in the sustainable future of our nutrition. Demographic change and acute inefficiencies in production, distribution and consumption not only give rise to lucrative opportunities for investment: there is also the chance to make a constructive contribution to change.

Research Paper Q4/2024

Discover the top 4 key investment themes shaping 2025 and stay ahead of market trends.

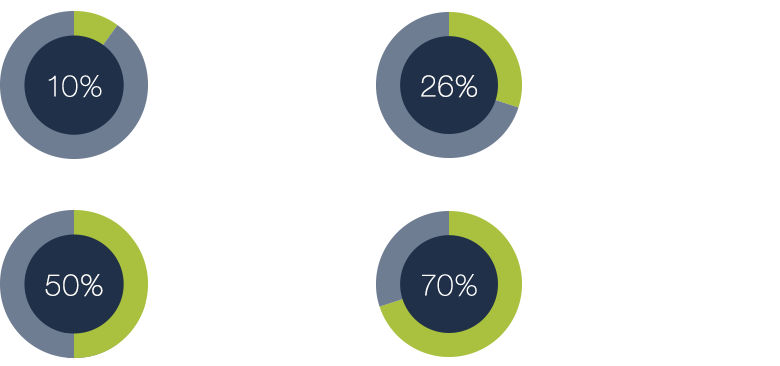

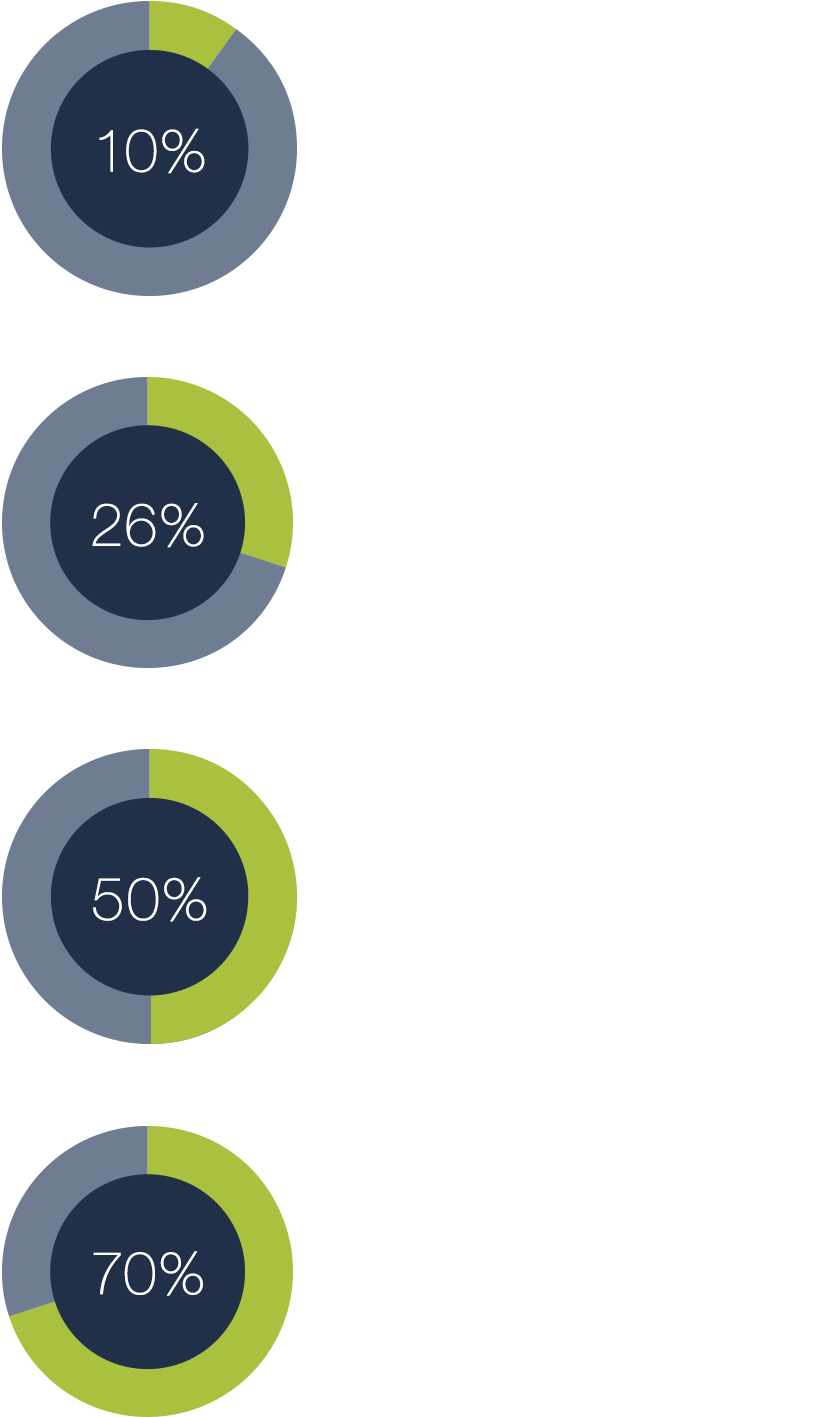

Food production is extremely inefficient

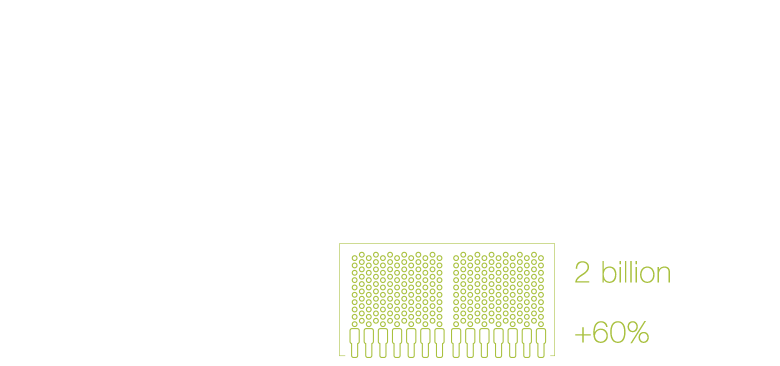

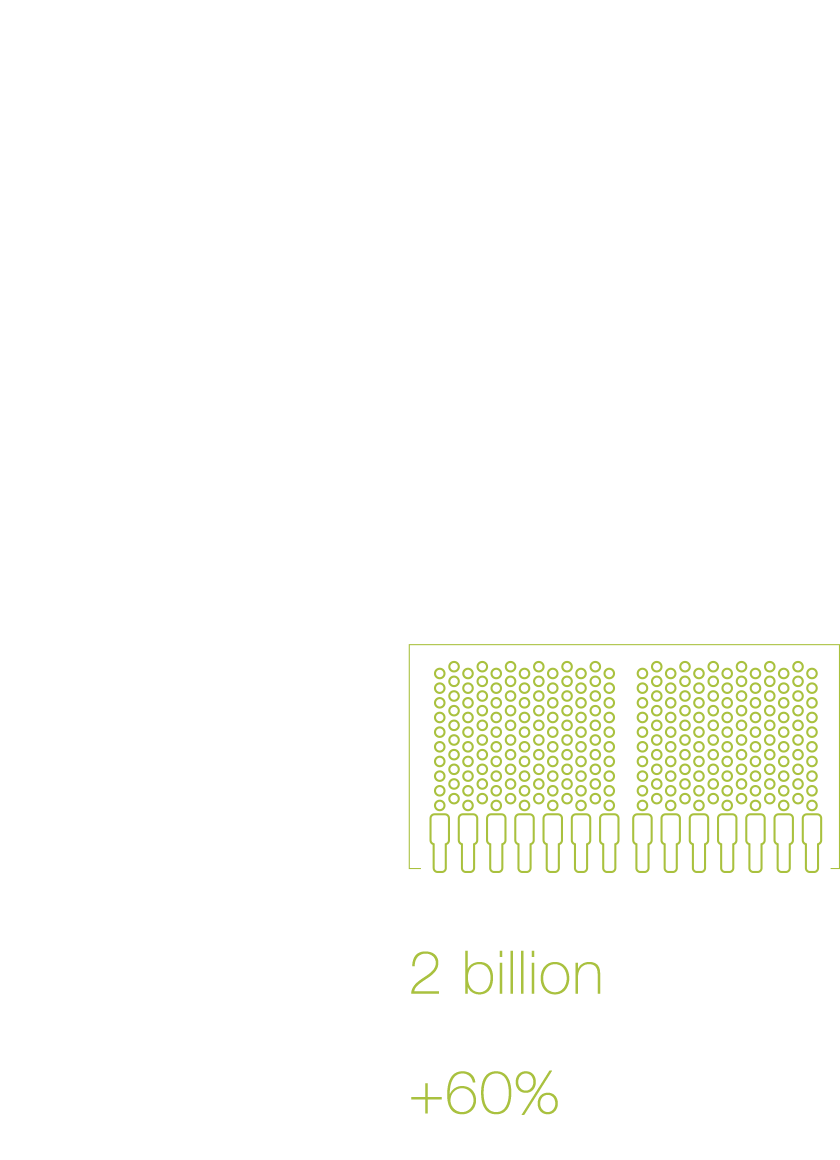

Need for foodstuffs will increase by 60% by 2050

The six sub-segments of The Food Revolution

Six structurally growing sub-segments shape the shift towards a sustainable, efficient food industry. As part of our ‘Food Revolution’ strategy, we identify 40-60 companies along the agri-food value chain that have a key impact on the development of these markets.

‘If everyone were to follow a typical American diet, we’d need the resources of two Earths’

In the video, fund manager Elad Ben-Am offers a detailed explanation of the strategy behind the fund ‘The Food Revolution’ from Picard Angst. Read the interview in our Insight.

Two professional athletes are ambassadors for "The Food Revolution"

Watch why Sina Frei, Olympia Silver Winner in Cross Country Tokyo 2020, and Jost Brücker, Professional Handball Player at GC Amicitia, are committed to "The Food Revolution" as professional athletes.

Product information

The Food Revolution by Picard Angst is a global equity fund with the objective of capitalizing on the structural changes at work, in the agri-food industry. We invest in 40 to 60 listed stocks along the value chains of six structurally growing segments.

PA Ucits – Food Revolution Fund Institutional CHF LU2318335523

| Key information | |

| Share class | C CHF |

| Target audience | Institutional Investors |

| Currency | CHF (no currency hedging) |

| Utilisation of returns | Accumulation |

| Minimum initial subscription | 1 million |

| Tradeability | Daily / until 2 pm CET |

| Legal structure | UCITS V |

| Fund domicile | Luxembourg |

| Authorized for public distribution | LU, DE, CH, FR, UK |

| Fund launch date | 30 April 2021 |

| Investment start | 12 - 30 April 2021 |

| End of financial year | 31 December |

| Valor | 110467897 |

| ISIN | LU2318335523 |

| Costs | |

| Management fee (p.a.) | 0.90% |

| Organisation | |

| Investment manager | Picard Angst AG |

| Management company | FundPartner Solutions (Europe) S.A. |

| Custodian bank | Pictet & Cie (Europe) S.A. |

| Auditors | Deloitte Luxembourg |

For more share classes go to the download center or get in touch with your personal contact.

PA Ucits – Food Revolution Fund Retail CHF LU2318335283

| Key information | |

| Share class | A CHF |

| Target audience | All investors |

| Currency | CHF (no currency hedging) |

| Utilisation of returns | Accumulation |

| Minimum initial subscription | No minimum |

| Tradeability | Daily / until 2 pm CET |

| Legal structure | UCITS V |

| Fund domicile | Luxembourg |

| Authorized for public distribution | LU, DE (pending), CH (pending) |

| Fund launch date | 30 April 2021 |

| Investment start | 12 - 30 April 2021 |

| End of financial year | 31 December |

| Valor | 110465559 |

| ISIN | LU2318335283 |

| Costs | |

| Management fee (p.a.) | 1.50% |

| Organisation | |

| Investment manager | Picard Angst AG |

| Management company | FundPartner Solutions (Europe) S.A. |

| Custodian bank | Pictet & Cie (Europe) S.A. |

| Auditors | Deloitte Luxembourg |

For more share classes go to the download center or get in touch with your personal contact.

The Food Revolution portfolio structure

High-conviction positions

|

|

Regular positions

|

|

Small-cap basket

|

Six good reasons to invest in The Food Revolution

Impact

With this investment, you are playing a constructive role in solving the key problems of our future.

Timing

Pandemic, meat scandals and structural triggers will greatly propel the Food Revolution.

Sustainability

The Food Revolution supports the UN’s SDG sustainability goals and the EU’s Farm to Fork initiative.

Potential returns

The Food Revolution offers very attractive potential returns, independent of the economic cycle.

Demographics

Demographic developments are one of the strongest arguments for The Food Revolution’s success.

Regulation

The political pressure on the food industry to integrate its real costs is picking up pace worldwide.

Your contacts

Elad Ben-Am

Senior Portfolio Manager Food Revolution

+

Boris Ivankovic

Senior Solution Advisor

+

Jann Breitenmoser

Senior Investment Manager Food Revolution

+

Important legal information:

We would like to inform you that telephone calls made to our phone lines are recorded. We assume that you are in agreement with this when you call.

This presentation draft represents a future project from Picard Angst. It is not an offer or invitation to buy or sell securities. It is intended for informational use only. Investments should only be made after the fund documentation in question has been read thoroughly. This presentation does not contain binding information; the offer documentation is the sole legally binding documentation.

The “Directives on the Independence of Financial Research” from the Swiss Bankers Association do not apply to this presentation. We wish to make you aware that it cannot be excluded that Picard Angst AG has a vested interest in the development of the price of individual titles or all the titles listed in this document.

The value and returns of the shares can increase or decrease. They are influenced by market volatility and currency fluctuation. Picard Angst AG accepts no liability for any losses. Past performance of values and returns is no indicator of ongoing and future performance. The performance of values and returns does not take into account any charges and fees incurred upon purchase, redemption and/or exchange of the shares. The allocation by country, currency and individual items, and any benchmarks stated, can change at any time within the framework of the investment policies stated in the legal prospectus.

All statements can be changed without prior notice. Statements can differ from estimates given in other documents published by Picard Angst AG, including research publications. Neither the entire document nor parts thereof may be reused or redistributed. While Picard Angst AG is of the opinion that the information included herein draws on reliable sources, Picard Angst cannot guarantee the quality, accuracy, validity or completeness of the information contained within this document.

If the fund, partial fund or share class is not registered for public offer and sale, the sale of shares can only be undertaken within the framework of private placements, or in the institutional domain, with regard to applicable local laws. The fund may not be sold in the USA nor to US citizens, neither directly nor indirectly.

Picard Angst AG is an asset manager handling collective capital investments pursuant to the Federal Law on Collective Capital Investments and is subject to the oversight of the Swiss Financial Market Supervisory Authority.