1. Macroeconomic Trends

Feelings of elation thanks to monetary policy’s liquidity injections

Dr. David-Michael Lincke, Head of Portfolio Management

In brief

- Preliminary signs of stabilisation in some leading indicators have rekindled optimism with regard to the economy, but hard economic data and other indicators are yet to confirm this.

- In contrast to previous phases of economic weakness, China's stimulus efforts have had little effect so far and turned out to be much smaller in scale. If China has indeed reached the limits of its potential, the world economy is in danger of a continued and prolonged downturn.

- In the United States, the danger of a slide into recession has by no means been averted, even if the inversion of the yield curve has disappeared again.

- In contrast, with the exception of China, things are looking more positive for emerging markets, especially as many of these economies have considerable room for manoeuvre in their monetary and fiscal policies.

- Belief in the all-powerfulness of the central banks is is increasingly being shaken. In particular, ever more doubt is being cast over the usefulness of negative interest rates. That said, however, liquidity injections have not yet lost their impact on the financial markets. But it is doubtful whether the global turnaround in monetary policy to a course of renewed easing can actually avert the danger of a recession.

- The outlook for global bonds looks bleak. However, emerging market bonds offer a ray of hope, not only in view of the comparatively high yields to maturity, but also against a backdrop of significantly undervalued currencies.

- There is still no end in sight for the trade conflict between the United States and China. Hopes have become focused solely on concluding a minimal agreement, while the resulting uncertainty continues to increase world trade volumes.

- The sharp fall in inflation expectations contrasts with the robust development of spot inflation in the United States. This opens up opportunities in inflation-linked bonds.

- Despite falling key interest rates, the US dollar has remained strong so far; this is likely to change in the coming year, however.

Outlook

Despite preliminary signs of stabilisation in individual leading indicators, there are still few indications that the global economic downturn is at an end. The impression that China has reached the limits of its stimulus potential in light of the debt bubble is particularly worrying. Even though the central banks around the world have adopted an easing course, the historical example does not inspire much confidence that this alone can steer growth in a different direction. In addition, there is still no end in sight for the trade conflict between the United States and China.

Comment

China reaches the limits of growth stimulation

The effects of the trade conflict between the United States and China are often used to explain the slowdown in the global economy that has been observed for some time. However, its origins lie in the slackening of stimulus efforts between 2015 and 2017, which China used to counter the recent slump in the domestic economy.

To boost credit creation, local government agencies were encouraged to issue large amounts of bonds and invest the proceeds into infrastructure projects. The shadow banking system was also mobilised; this tripled in size in 2016 alone. The consequence was a reactivation of the domestic property and infrastructure bubble, the effect of which was exported and saved the global economy from drifting into recession.

Since the global financial crisis, China, with its stimulus measures for the global economy, has repeatedly missed out on the energy boosts needed in critical situations to remain on a growth course. This can be clearly seen in what is known as the credit impulse, which relates the extent of credit creation in an economy to the growth rate of gross domestic product (GDP) (see Fig. 1). However, its development also shows that the intensity of economic stimulus measures has gradually decreased over the last decade.

Fig. 1

Chinese credit impulse: The intensity of the economic stimulus measures has gradually weakened over the last decade

The credit response to the current phase of weakness, which has pushed Chinese GDP growth below the 6% p.a. threshold, has so far been minimal. This is probably due to the massive debt bubble resulting from the massive financing of unproductive investments in the past, which has caused Chinese productivity growth to stagnate.

Nevertheless, the Chinese government has also tried to stimulate credit creation further this year; this has caused the country's debt quota, which was still declining in 2018, to rise to over 250% of GDP. While the economy quickly responded to such measures in 2015/16, the reaction in the current year has been extremely timid. Economic growth has fallen to its lowest level since 1992.

China seems to have reached the point where moderate stimulus measures are losing their effectiveness, and any further strengthening of the measures risks triggering a debt crisis. While central banks in the rest of the world have also returned to a course of easing, the central role played by China in maintaining expansion over the past decade suggests that the economic cycle is coming to an end. The financial markets, and especially the stock markets, have not yet received this message. Yet the divergence from the real economy will close in one direction or the other over the coming year.

Preliminary signs of stabilisation, but no resilient turnaround in global economic outlook

The economic weakness is concentrated in the manufacturing sector. Against the backdrop of ongoing trade disputes, economies that are very open and have a high export share are particularly affected. In Europe, this applies in particular to Germany and also Sweden.

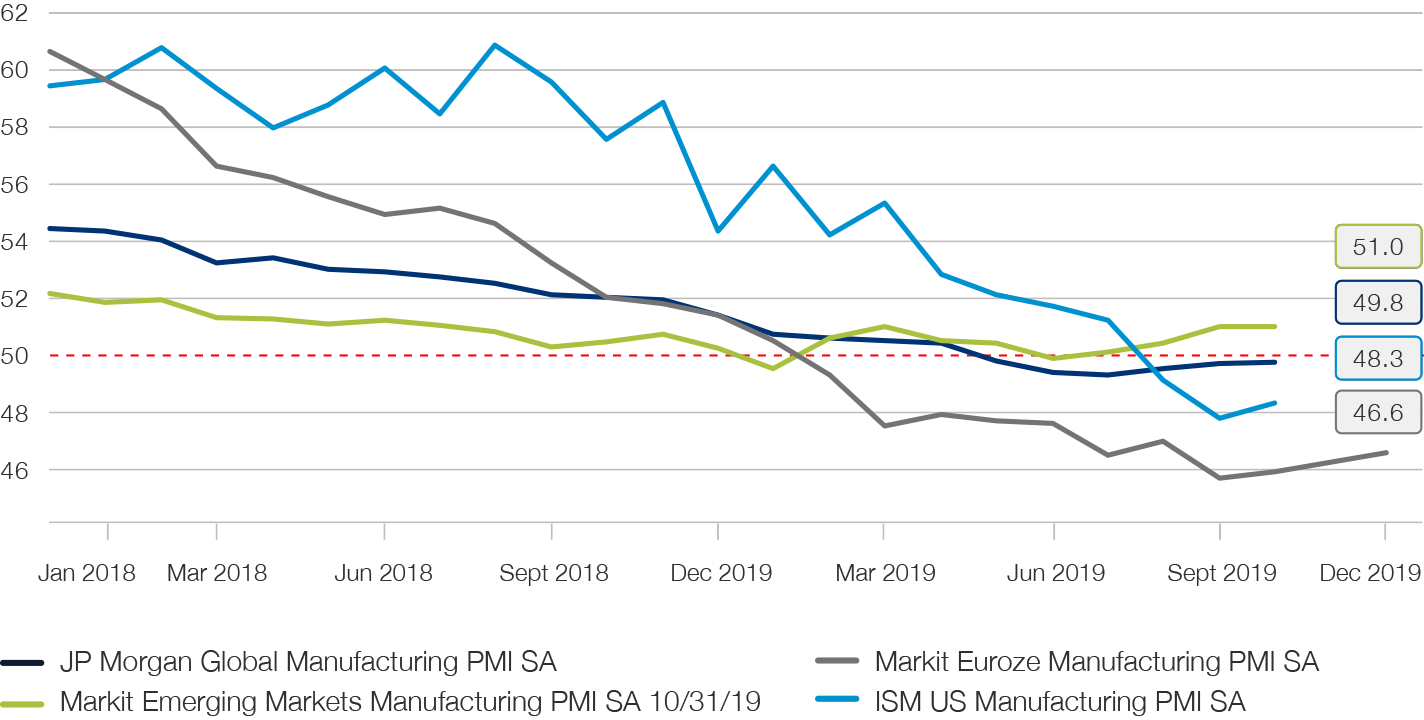

Fig. 2

The weakening trend in leading economic indicators remains intact, but is only showing signs of stabilisation at a low level

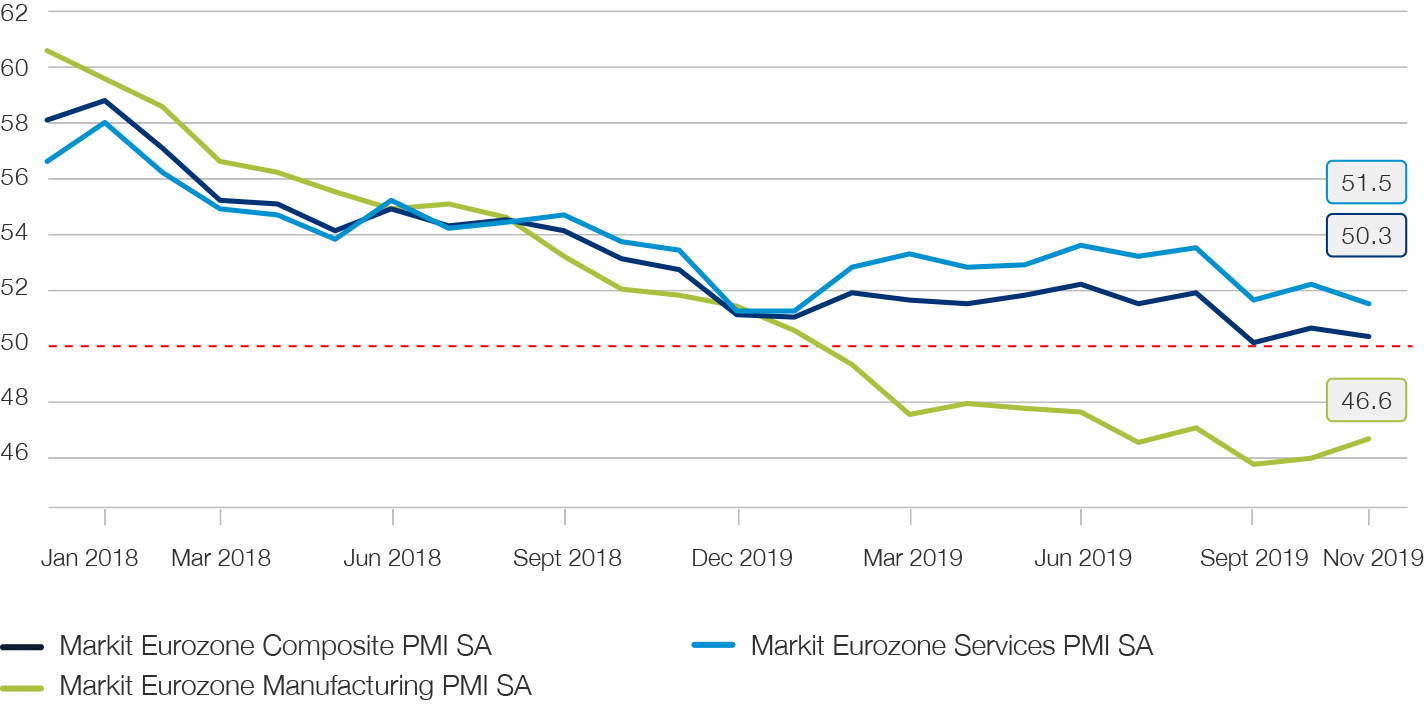

In contrast, demand for services, which are predominantly domestically focused by their very nature, is much more robust and remains on a global expansion course. This contrast is particularly marked in the eurozone (see Fig. 3).

In October and November, the purchasing managers' indices of many economies showed the first signs of stabilisation at a low level, which was met with relief by the financial markets. However, there are still no data points to confirm these survey values. Over the same period, only 16% of the leading OECD (LEI) indicators recorded an increase. Hard economic data continues to fall sharply, with the exception of labour market data, which has shown astonishing resilience in both Europe and the United States. However, the latter is a lagging indicator. There are also indications that the current stabilisation of leading indicators merely reflects the expectation of demand in China in anticipation of new tariffs coming into force in September and potentially in December.

Fig. 3

Weakness concentrated in manufacturing industry, while demand for services is surprisingly robust

Estimates for global economic growth were significantly revised downwards in the second half of the year. For example, the International Monetary Fund (IFW) expects growth of only 3.0% instead of 3.4% in 2019, the lowest rate of expansion of the global economy since 2009. While the IMF remains optimistic for 2020 and forecasts a growth recovery of 3.4%, the OECD expects growth to stagnate at the low level of 3.0%.

Europe will likely continue to suffer from political paralysis and confrontation in 2020. With marginal growth of 0.01% in Q3 2019, Germany has once again escaped a technical recession by the skin of its teeth. However, there is still no political will to make use of the fiscal leeway and support the economy with government investment programmes. Although the budget conflict between Italy and Brussels has defused as a result of the government reshuffle, the political process in the European Union remains marked by discord and disagreement. The fact that Britain's withdrawal from the European Union has been further delayed is of little help. This keeps the general uncertainty about the future path of the economic bloc high.

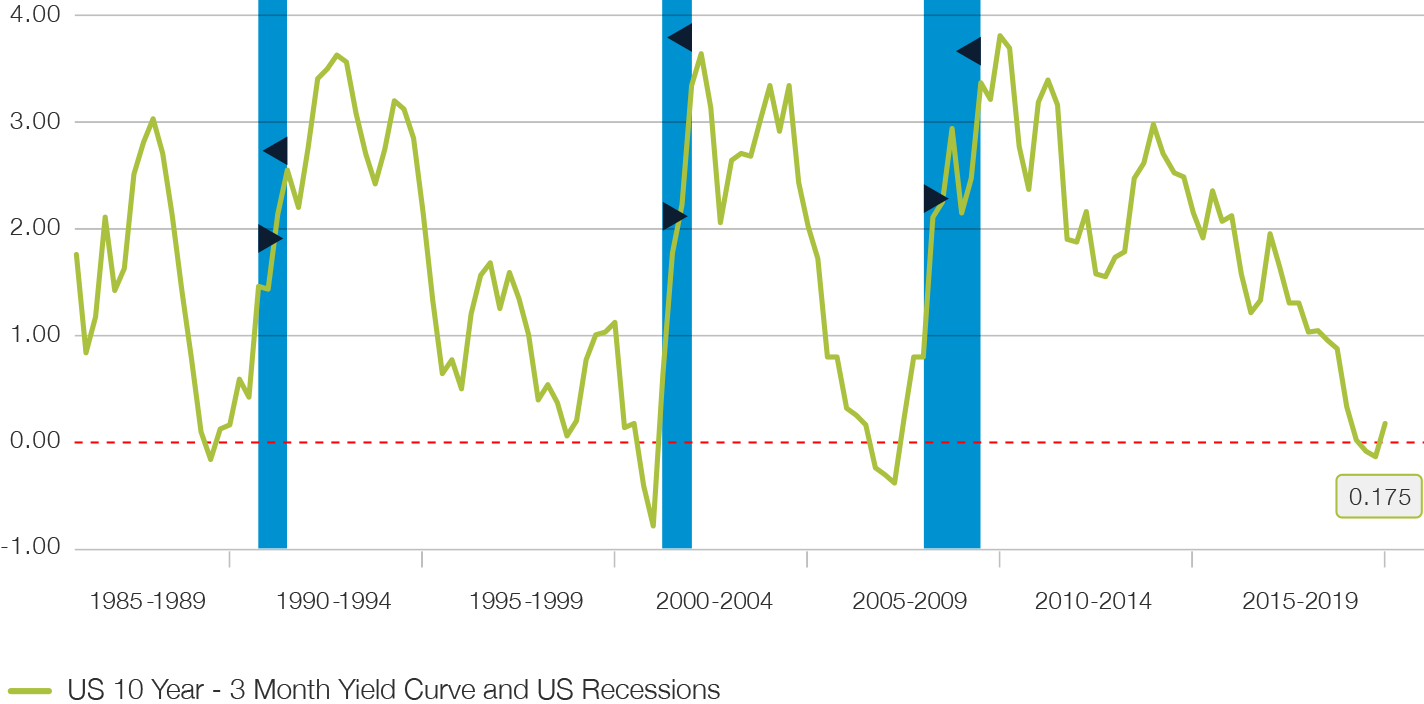

Danger of recession not averted in the United States

Over the summer, the inversion of large parts of the yield curve sparked fears of a recession in the United States. This is a development that has proven to be a reliable harbinger of any recession since the Second World War, albeit with considerable amount of variability with regard to lead times.

Since declining risk aversion and the resumption of bond purchases by the Federal Reserve have contributed to a reversal of this inversion, many of those issuing warnings have fallen silent. The historical track record shows that such a reversal of the inversion of the yield curve often occurs shortly before the onset of a recession and accentuates itself in the course of the recession. This development is driven on the one hand by measures taken by the central bank to lower key interest rates at the short end and, on the other, by the market's expectation, that growth will recover as the recession subsides, which is expressed in rising yields to maturity at the long end (see Fig. 4).

Fig. 4

Reversal of the US yield curve inversion before going into recession

The arguments against a recession occurring in the United States in the coming year or 2021 at the latest are sparse. For example, the fiscal stimulus from last year's tax reform has been exhausted. Hopes of a broad-based investment boost from companies have not materialised. Although full employment on the labour market is fundamentally positive, it also means that there is no reason to expect a continued spurt in exceptional employment growth. Due to the combination of demographic factors and sustained declining productivity growth, future real growth rates of barely more than 1% p.a. can be expected for the United States.

It should also be borne in mind that, in the case of the United States, this is now the longest economic expansion in the post-war period. From a mere statistical point of view, a recession is therefore becoming more and more likely. Various regional and sector-specific economic indicators as well as surveys among the executive management of large companies are providing increasingly clear early warning signals about an impending downturn.

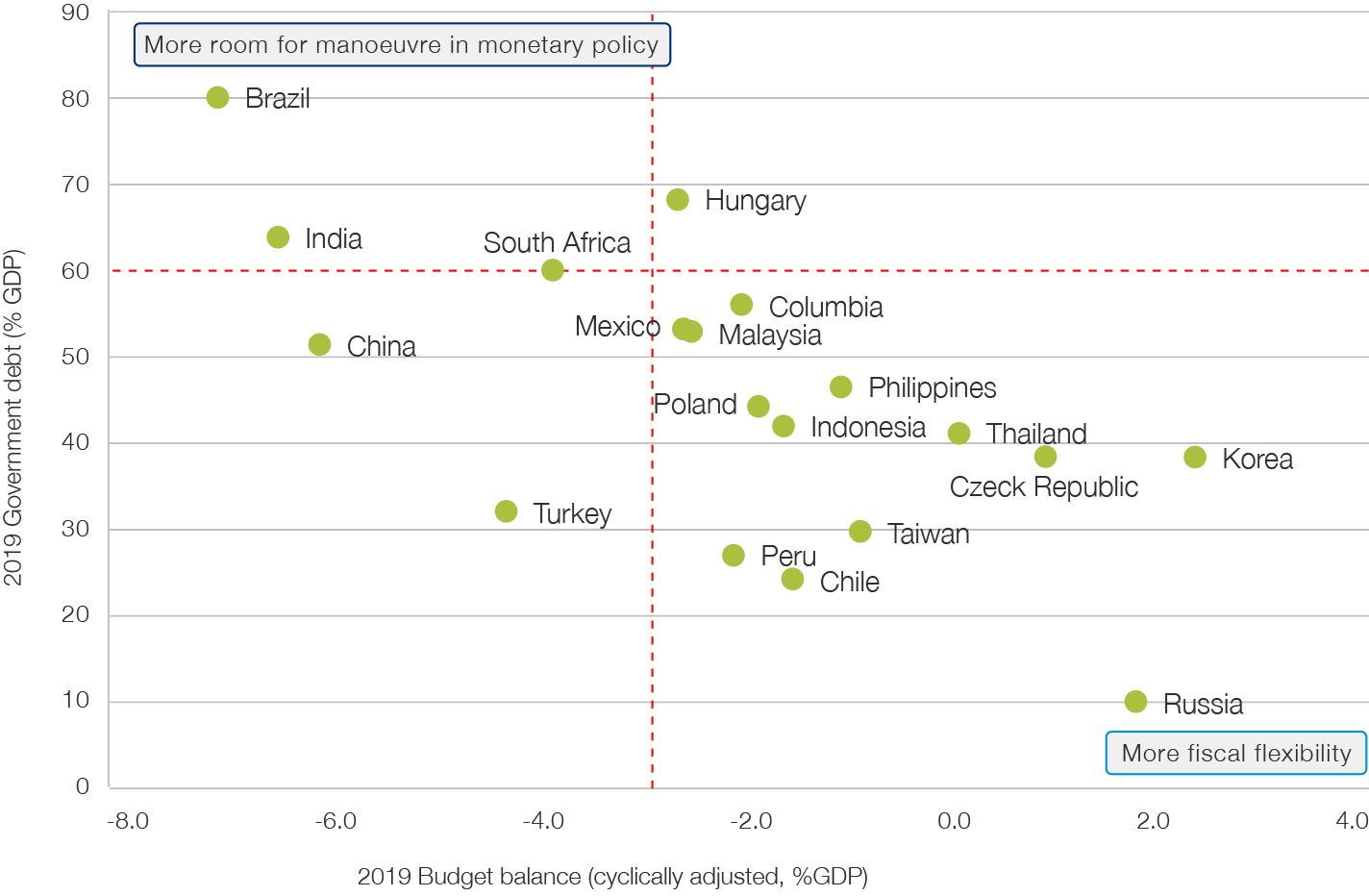

Emerging markets show first signs of stabilisation

In recent years, it has become increasingly difficult for emerging market economies to fulfil their given role as the growth engine of the global economy. The fiscal and monetary stimulus measures introduced by China over the past year have had only a very limited impact (see above). It is questionable whether they will be sufficient to stabilise the growth path of the Chinese economy near the 6% mark, especially as the trade conflict with the United States increasingly produces headwinds. However, with the exception of China, many emerging markets offer a glimmer of hope for the global economy.

Fig. 5

Many emerging markets posses monetary and fiscal room to manoeuvre to counter a further downturn

As expected, the emerging markets suffered from the slump in global trade. In particular, the commodity-exporting nations of South America are feeling the effects of the significant decline in prices and volumes in their export markets. Many South American countries have experienced the second recessive phase in three years, which puts their political systems under severe pressure. Now, however, it looks as if stabilisation could happen not only in this part of the world, but also in other emerging market regions.

This is mainly due to monetary policy’s existing room to manoeuvre. While monetary policy is to a large extent exhausted in the developed countries, countries such as Turkey, Mexico, Brazil and South Africa have a great deal of monetary room for manoeuvre, which they are happy to use, as a series of interest rate cuts in recent weeks shows. The interest rate cuts issued by the US Federal Reserve in recent months have even increased this room for manoeuvre (see Fig. 4).

At the same time, there are many countries that have either deep deficits or even - in the case of countries such as South Korea or Russia - significant budget surpluses. This will enable them to increase their fiscal expenditure if necessary.

Belief in the all-powerfulness of the central banks is increasingly showing cracks

The central bankers are pulling out ever bigger guns in their fight against feared deflation. But far from using a sledgehammer to crack a nut, the effect has failed miserably for ten years. However, instead of taking this as an opportunity to go over the books and fundamentally rethink the strategy, they are now merrily making another attempt, in keeping with the motto “a lot helps a lot”.

Against this backdrop, even the most disposed sections of the analyst and media class now have serious doubts that the set objectives can ever be achieved this way. On the contrary, everywhere there is suspicion and fear that all the financial repression, with its increasingly negative interest rates, has become rather counter-productive and is cementing the economic growth malaise.

The idea that the average citizen could be urged to spend more money by paying a negative rate of interest on their savings, while consumer prices continue to rise slowly but surely, could only seem plausible to economists in the academic ivory towers of central banks. On the contrary, there is a growing impression that the prospects for pension fund assets and old-age provision are gloomy and that we will have to save even more for a rainy day.

Apart from a few exceptions such as the Swedish Riksbank, all this still hasn’t shaken the central banks from their belief that ever lower and more negative key interest rates are a proven remedy, if one would only steadily increase the dose. The question remains how much of this stagnation society is still willing to tolerate before established dogmas are exposed as magical thinking and vodoo in the eyes of the public.

The US Federal Reserve has now completed its move away from a hesitant normalisation path. Not only has there been no interest rate hikes over the past year, but key interest rates have now been lowered three times in a row. As the Federal Reserve regards the current economic slowdown as only a temporary phase of weakness, we do not expect further interest rate cuts in the coming year until there are acute signs of recession. However, given the level of only 1.5% of the Federal Funds Rate, the remaining dry powder to combat such a scenario is limited.

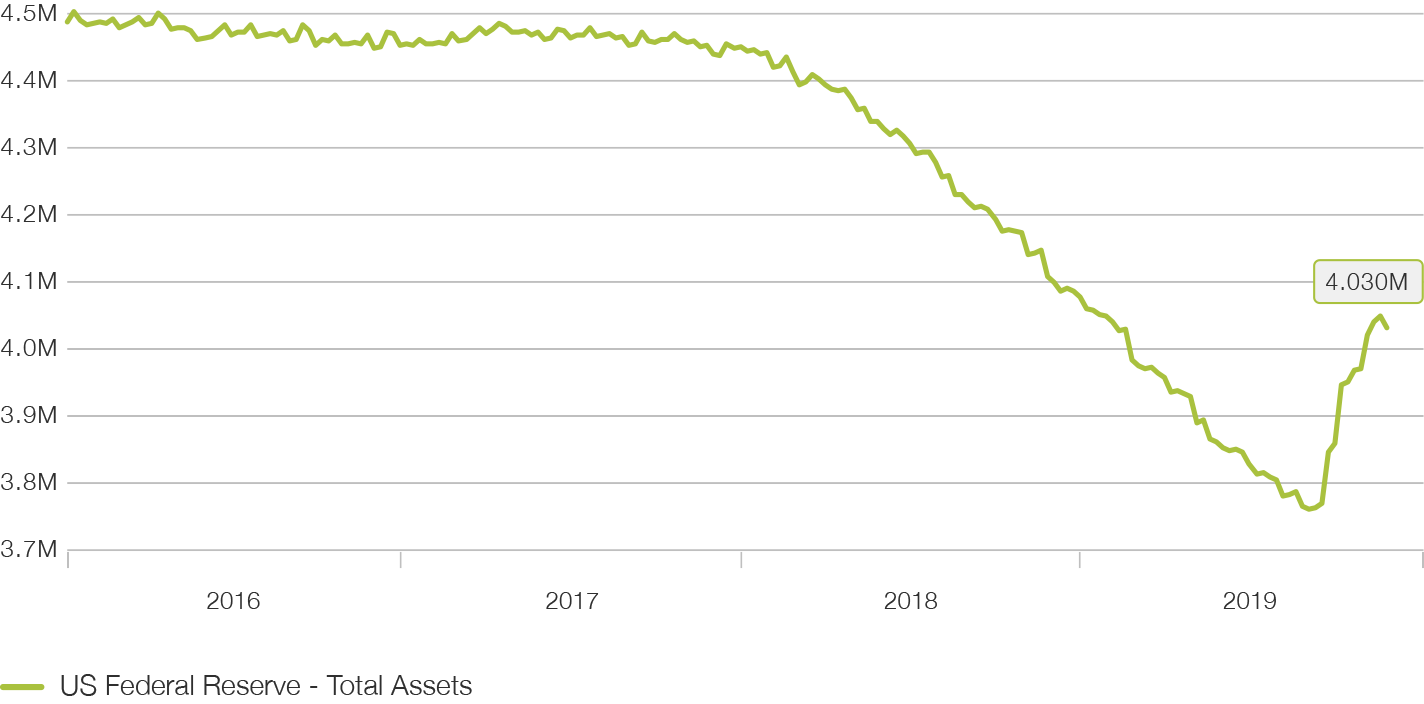

In addition, not only has the Fed ceased its efforts to normalise its balance sheet, it has also begun to inflate it again by introducing a new USD 60 bn per month purchasing programme (see Figure 6). The new purchases became necessary due to a surprising shortage of reserves in the US banking system as a result of the massive increase in the need to maintain liquidity since the global financial crisis due to stricter regulations. Even if this makes the intention behind the measure different from previous quantitative easing programmes, the effect on the central bank balance sheet is the same.

Fig. 6

The US Federal Reserve Bank's balance sheet again experiences considerable growth

It is indeed correct to argue that restricting purchases to short-term money market instruments (US Treasury Bills) does not have the same transmission effect as absorbing long-dated government bonds. However, the markets for risky assets, in particular the equity market, have not yet followed this differentiation and have appreciated significantly since the introduction of the programme.

Despite all these measures, however, the question arises as to whether it is not already too late for the Fed to turn the tide and successfully avert a recession. The historical track record is not very encouraging. With the exception of 1967 and 1996, every interest rate cut that followed a cycle of rising interest rates inevitably led to a recession. With a remaining cushion of only 150 basis points, there is considerably less ammunition available this time than in previous economic downturns, when the central bank felt compelled to lower key interest rates by an average of 375 basis points.

European Central Bank's (ECB) options are even more limited, as it did not care to normalise monetary policy in the first place. On the contrary, key interest rates were cut further into negative territory in September and additional interest rate cuts were not ruled out. However, in view of the precarious condition of the European banking system, which suffers severely from this, the remaining room for manoeuvre is severely limited. For this reason, banks have been granted allowances in line with the Swiss model, which in turn reduces the effectiveness of further interest rate steps. Against this backdrop, it is hardly surprising that the quantitative easing programme was again reactivated after it had only been discontinued at the beginning of the year. One gets the impression that the ECB is increasingly manoeuvring itself into a dead end. Accordingly, there is also a loud call coming from central bank circles for fiscal policy to play a stronger role in supporting the European economy. Nevertheless, even after Christine Lagarde took over from Mario Draghi, the ECB has not yet sent a signal that it would consider fundamentally questioning and rethinking its policies.

Bleak outlook for bonds brightened by bright spots in emerging markets

The outlook for global bonds remains gloomy. Valuations are extremely high and inflation is weighing on yields. Real yields are at a record low of 1.4%.

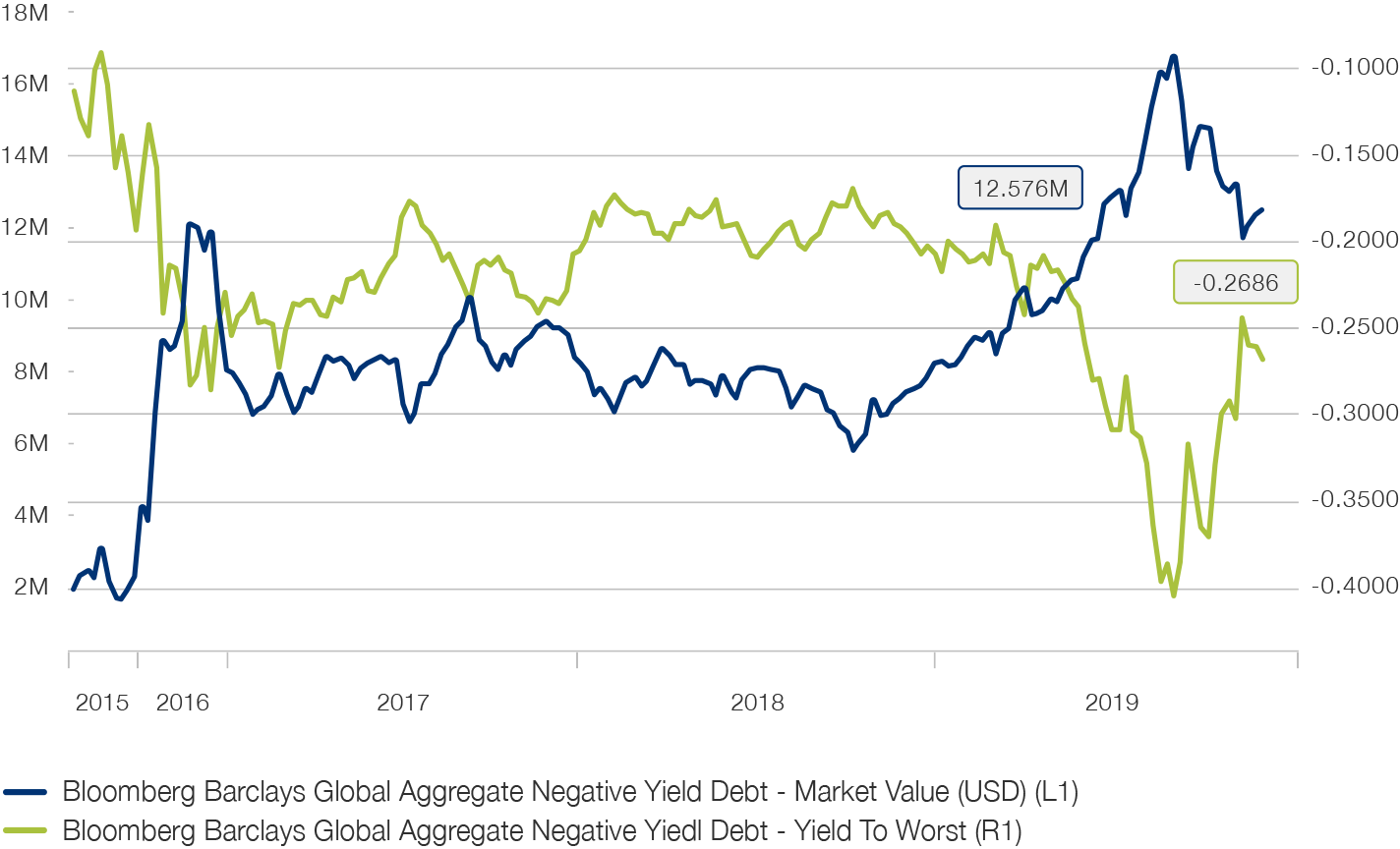

Although the share of negatively yielding bonds has declined somewhat over the past few months, at USD 12.4 bn it remains above the 2016 high (see Fig. 7). The weighted average yield to maturity on these commitments has recovered significantly since the summer, but is still quoted at -0.26% p.a. This means that half of all outstanding European government bonds and 20% of the universe of European corporate bonds with investment grade ratings are bearing negative interest rates.

Fig. 7

Global market value of negative interest-bearing bonds has risen to a new record high

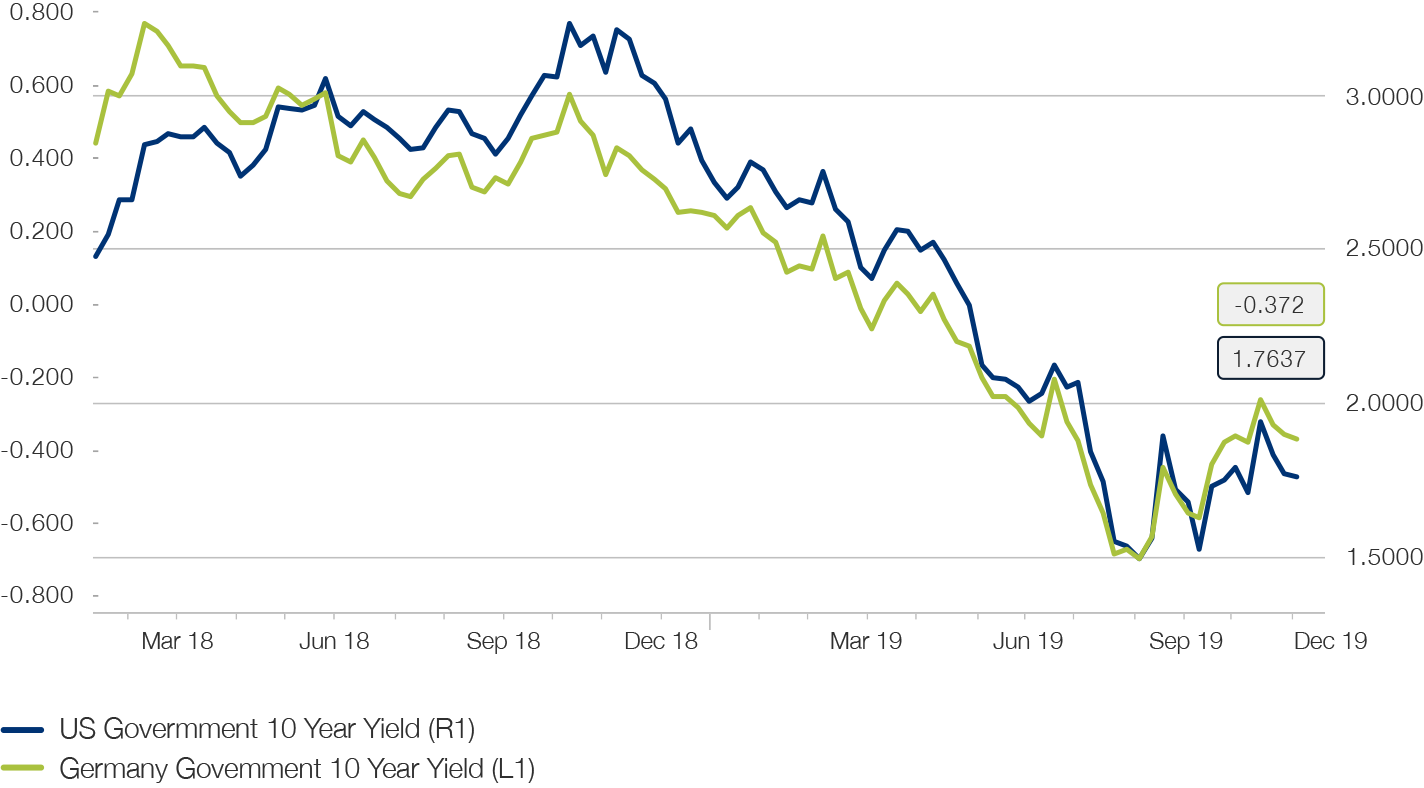

Falling yields on government bonds have recovered from the summer lows, but remain caught in an overall downward trend (see chart 8). This reflects the weak economic outlook and the ever-present danger of many developed economies sliding into recession. Therefore, without corresponding resilient indications of a recovery in the economic outlook, we consider a further rise in yields to maturity to be an attractive opportunity for an increase in portfolio duration, particularly in the case of US government bonds.

Fig. 8

Falling yields on government bonds have recovered from summer lows, but remain caught in a downward trend

There are also rays of hope, however; in the bond markets, these are emerging market bonds. Although the yield on emerging market bonds in local currency fell to an all-time low in October, the asset class continues to offer the best outlook of any major bond market. On the one hand, the yield of 5% p.a. is still considerably higher than that of other bonds. In addition, emerging market currencies appear very attractive. They are substantially undervalued against the US dollar and, given the relative growth trend, there are good prospects that this discount will decrease in the coming year. This will give an additional boost to emerging market bond yields. In addition to government bonds issued by emerging markets, corporate bonds issued by emerging markets are also of interest.

In contrast, corporate bonds are less attractive in industrialised countries. It is not only the high valuations that act as a deterrent, but also the historically low ratings of companies. The ratio of companies with a CCC rating to those with a B rating is currently even higher than during the 2016 energy crisis, a very difficult market phase for high-yield bonds.

European investment-grade bonds, for example, yield a meager 0.4% p.a. in a situation where Germany is threatening to slide into recession. This is all the more worrying given that global earnings growth is slowing sharply and has been declining over the last three quarters.

There is still no end in sight in the trade conflict between the United States and China

After a repeated back and forth with phases of escalation, which were in turn replaced by phases of de-escalation, the situation in the trade dispute between the United States and China at the end was almost back to where it was at the beginning of the year.

It is certainly true that it was primarily the trade deficit with China which the Trump administration initially took exception to. It should not be forgotten, however, that the conflict has a much wider dimension and meaning. Ultimately, the United States is concerned with keeping an emerging competitor for global economic and military supremacy in check. This explains its increasing focus on the technology transfer forced by China, the danger posed by China's monitoring of foreign companies and President Xi's 'Made in China 2025' plan, which directly threatens the USA's technological dominance. The sanctions against the Huawei technology group should also be seen in this context.

Against this backdrop, it can be assumed that the core of the conflict will persist over the long term and that it will present a structural headwind with regard to the further expansion of world trade.

One could even argue that the globalisation of the world economy has not only stalled, but is already in reverse gear in many places. Globalised supply chains are being dismantled again. The focus of companies is becoming more regional. We are moving from the vision of an integrated unipolar economic system to a multipolar world. As a result, friction in commercial traffic is increasing again and efficiency is decreasing.

Hence ambitions to see at least a partial settlement of the conflict have been greatly reduced over the last few months. The focus now lies on negotiating of a “phase one deal”, which deals only with those points that are of mutual interest, and thus open the door to a pragmatic agreement. On the American side, this includes the resumption of imports of US agricultural goods by China, while China is primarily interested in preventing a further increase and reducing existing tariff hurdles. However, as developments in recent weeks have shown, even an agreement on such a minimal deal seems by no means in the bag, and there are increasing rumours that a possible conclusion may not be reached until next year. This does not bode well for the chances of further agreements in subsequent phases, when far more controversial issues will be under discussion.

The global uncertainty triggered by the United States' new confrontational trade policy has already been reflected in the development of world trade. Trading volumes have been declining since the second half of the previous year, therefore (see Fig. 9). The IMF estimates that the tariff barriers introduced and uncertainty about future developments will reduce global economic growth by 0.8% by the end of 2020.

Fig. 9

World trade volume continues to contract

For the American economy alone, the consequences of continued escalation in the form of an extension of customs duties to all Chinese imports are much more dramatic. It is estimated that the US gross domestic product would be 0.75% to 1% lower and that credit spreads in the high-yield sector could widen from below 400 basis points to over 700 basis points.

In response to the tariffs levied against China, a reconfiguration of global value chains is already emerging. Vietnam in particular appears to be profiting from the withdrawal of production capacities from China. In addition, Taiwan, Chile, Malaysia and Argentina are enjoying an increase in direct foreign investment. India has also recently taken steps to increase its attractiveness as an alternative location for outsourcing value chains by reforming its corporate tax system.

There is also the danger that the next step in the escalation will be for the US administration to extend its confrontational trade policy to Europe, where the Americans cite the automobile sector as a particular thorn in their side.

The potential for rising inflation despite economic weakness is underestimated

The development of inflation expectations is another reason for monetary policy to have thrown all normalisation efforts out of the window over the past year. After a temporary recovery over the first quarter, these collapsed dramatically over the summer and have since recovered only partially. For example, the break-even inflation rate for ten-year US Treasuries remains at only 1.65 (see Fig. 10).

Fig. 10

US inflation expectations remain low despite rising spot inflation

One exception is the UK, where inflation expectations remain close to 3.5%; although this is likely to be largely due to persistent uncertainty about the UK's exit from the European Union and the associated inflationary consequences.

However, if one looks at the development of spot inflation in the United States measured by the Core CPI, it becomes clear that it is in a stable upward trend and is currently close to a ten-year high of 2.4% (see Fig. 10).

It can be expected that longer-term inflation expectations will at least approach the effective inflation level, even if they don’t manage to catch up. We therefore see potential for inflation-linked bonds in the United States.

The cover story of the American magazine Bloomberg Businessweek, which announced the death of inflation a few months ago, may turn out to be a classic contrary indicator over the longer term. The zeitgeist is changing and seems to be going in an inflationary direction. Warnings about over-indebtedness and budget deficits as well as warnings about more austerity have largely fallen silent. In return, radical theories such as "Modern Monetary Theory", which question the established separation of monetary and fiscal policy, have now become socially acceptable; they are not only finding a platform in leading press outlets, but have even become the subject of parliamentary debates. The days of disinflation and deflation that lasted since the early 1980s may therefore be numbered and may herald a regime that in some respects is more reminiscent of the inflation dynamics of the 1960s and 1970s.

Recovery potential with EM currencies

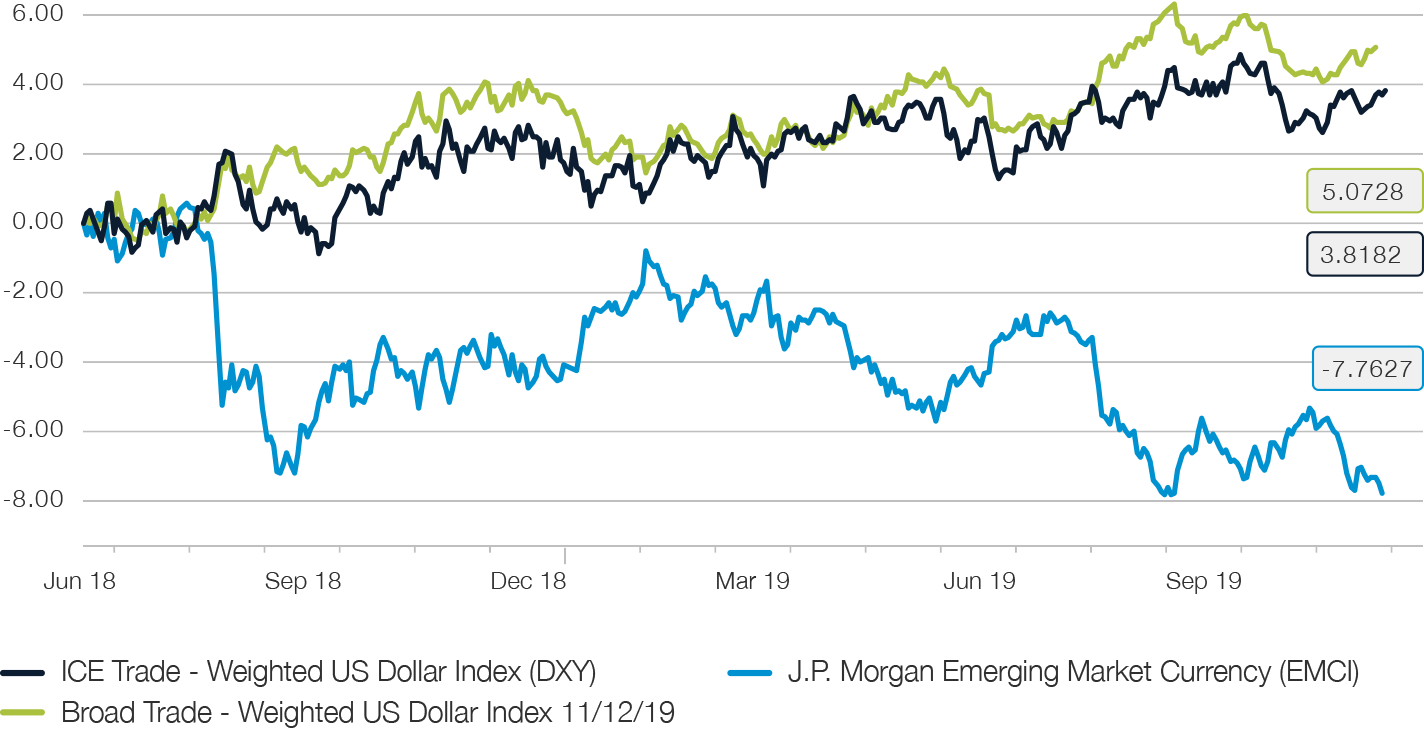

At the beginning of last year, there were many indications that the continued strength of the US dollar against both most developed country currencies and, to a much greater extent, emerging market currencies would soon come to an end. However the US currency also continued to soar in 2019.

Even the reduction of the EURUSD interest rate differential in the wake of three key interest rate cuts by the US Federal Reserve has left little impression on the US currency so far. A significant factor in this regard has probably been the shortage of dollar funding, which has been reflected in a steady rise in hedging costs, among other things, which have in the meantime exceeded the 3% per annum threshold for the euro, the Japanese yen and the Swiss franc. However, the Federal Reserve's easing measures in the form of repo transactions in the money market and permanent liquidity measures in the form of purchasing Treasury Bills on a large scale will put a stop to this development.

Fig. 11

Distinct divergences on the FX markets as a result of US monetary policy: Broad and narrow trade-weighted US Dollar vs. emerging currencies

The ever-expanding US budget deficit should also put a stop to the dollar shortage. In view of the declining attractiveness of US investments, it is difficult to imagine that the annual issue of USD 1.3 to 1.5 trillion of additional government bonds at the current currency level will motivate a sufficient number of foreign buyers.

The fact that the US dollar is clearly overvalued on a broad basis when measured against its real effective exchange rate also suggests a gradual depreciation.

As an election year, 2020 also entails special political risks. In the field of challengers, Elizabeth Warren has good chances of being nominates as being nominated as the democratic to take on Donald Trump, which is assessed as particularly negative by the financial markets due to her political convictions. The very possibility of a Warren presidency could put the dollar under pressure.

The emerging markets currencies are likely to turn out to be special benefits of a weaker dollar. In view of an undervaluation of 20% to 25% against the US dollar according to relevant models, the resumption of considerable capital inflows into these economies can be expected in the wake of a depreciation of the dollar.

Share Insight

Important notice

Note that telephone calls on our lines are recorded. By calling us we assume that you agree to your call being recorded. The Swiss Bankers Association’s ‘‘Directives on the Independence of Financial Research do not apply to this presentation. We wish to point out that Picard Angst Ltd. may have interests of its own in the price performance of one or more of the securities described in this document. This document does not constitute an offer or invitation to buy or sell securities. It is intended for information only. All opinions are subject to alteration without prior notification. The opinions expressed here may differ to opinions expressed in other documents published by Picard Angst Ltd. including research publications. Neither the document as a whole nor individual parts of it may be reused or distributed to other parties. Although Picard Angst Ltd. is of the opinion that the information contained in this document is based on reliable sources, Picard Angst Ltd. can accept no liability for the quality, accuracy, current relevance or completeness of this information.

© Picard Angst AG

Regulated by the Swiss Financial Market Supervisory Authority (FINMA).