4. Property

Property caught between negative interest rates and climate protection

Klaus Kämpf, Managing Director, Sustainable Real Estate AG

In brief

- Investments in investment properties have always paid off in recent years. Overall, the Swiss property market is in good shape.

- Rising vacancy rates and falling rents for rental flats seem to point to a trend reversal. A closer look reveals that these issues mainly concern outlying regions. In the cities and urban areas, there is still a lack of living space.

- Property used for commercial purposes is benefiting from the economic situation, which is still quite good despite a slight slowdown, and the positive outlook. Offer rents for office and retail space moved sideways in 2019.

- Everyone is talking about climate protection. Buildings account for more than a quarter of Switzerland's greenhouse gas emissions. A significant reduction in greenhouse gas emissions from buildings has been achieved since 1990, despite an increase in building space. Nevertheless, climate protection targets were not met.

- Climate protection is not the only long-term megatrend with which the property industry should start getting to grips with today. Demographic developments are also challenging property owners.

Outlook

There is much promising another good year for property investments in Switzerland. Given the low level of interest rates for the foreseeable future, investment properties and indirect property investments remain attractive. Rising transaction prices with a simultaneous tendency towards stagnating or even declining rents cause an erosion of returns on newly acquired property. The old wisdom "location, location, location" is gaining importance for new buildings.

So far, not even a third of the cantons have applied 2014’s stricter energy regulations. At the same time, given the increasingly ambitious climate protection targets, the next round of tightening is already foreseeable. However, climate protection targets will not be met by simply increasing the requirements for new buildings; there is enormous potential in the energetic renovation of the old building stock. Due to numerous obstacles in the short term, it is not to be expected that the amount of renovations will increase significantly. In the medium term, however, the industry cannot avoid it. At the same time, answers must be found with regard to an increasingly ageing population.

Comment

The risks in the Swiss property market are gradually increasing, but there is no end sight for the boom (so far)

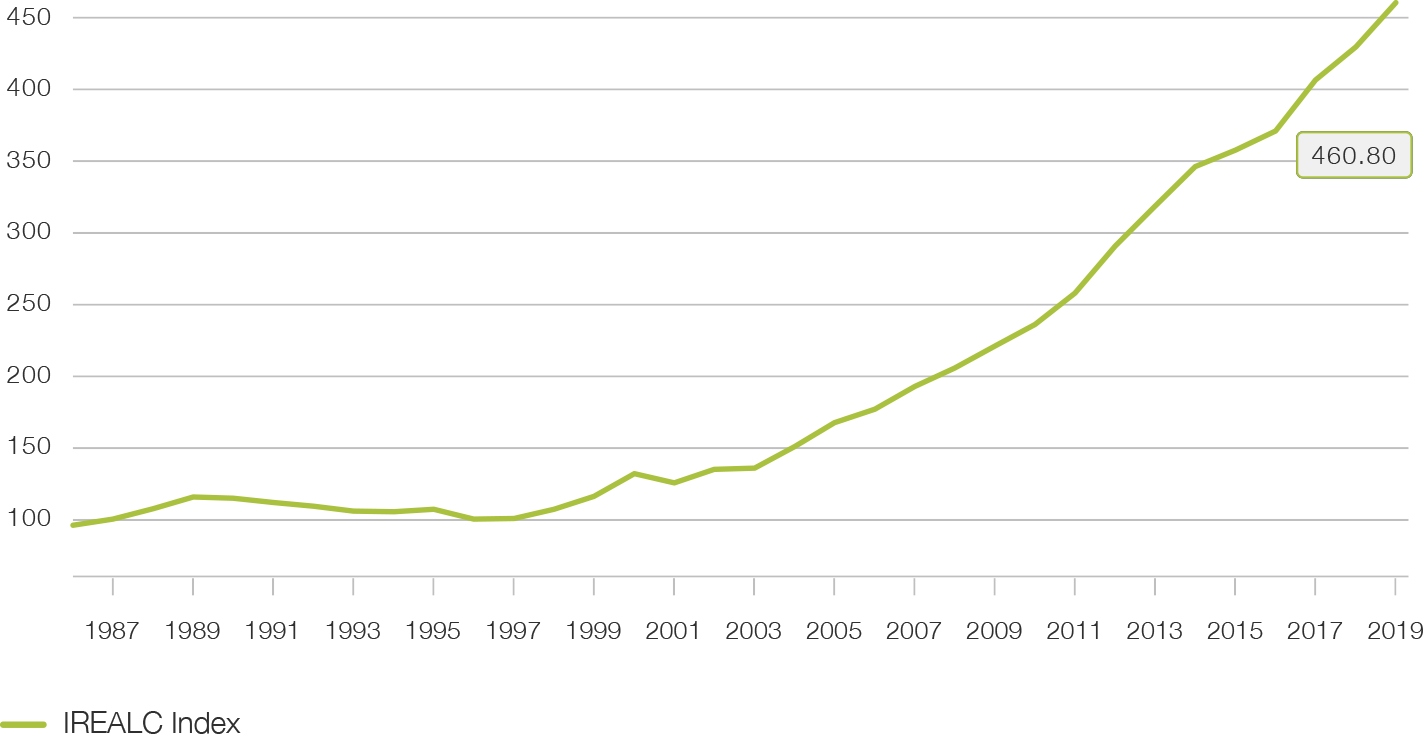

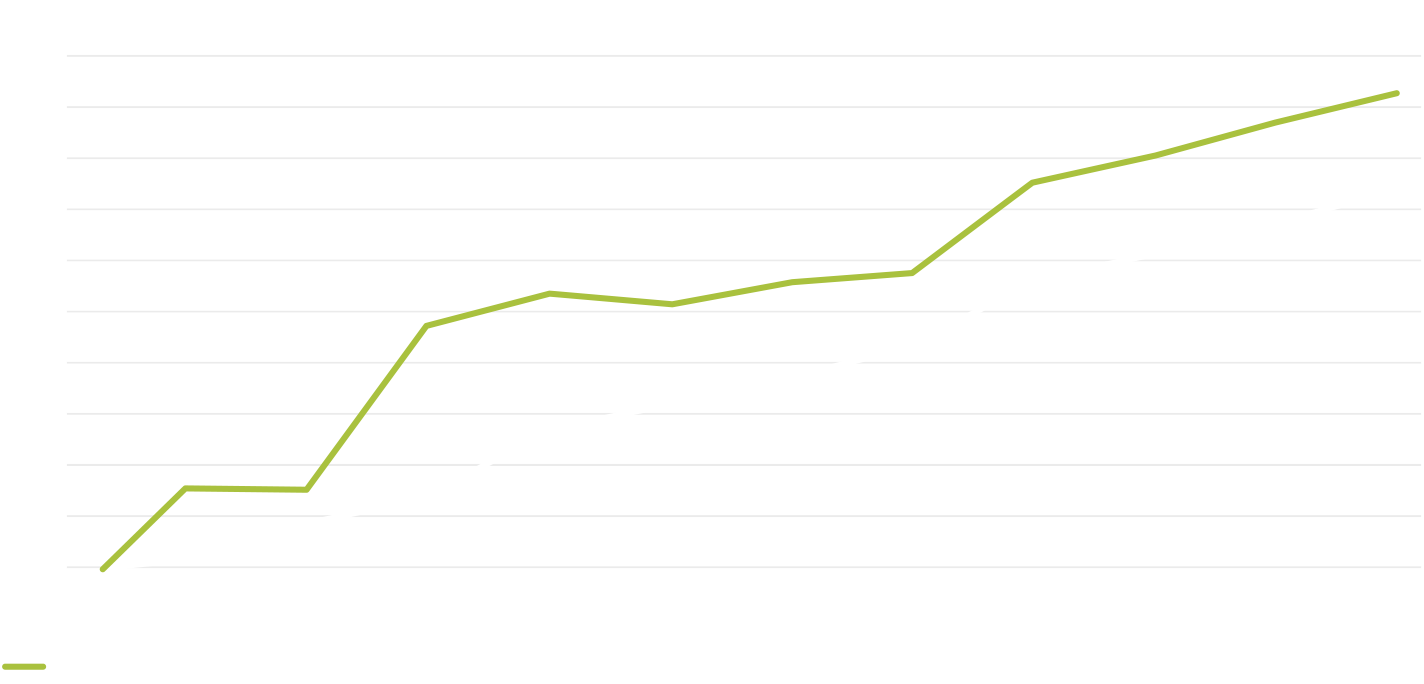

Swiss investment properties have been performing well for over 20 years (see Fig. 26). And all-important demand-relevant factors indicate that this will remain the case for some time to come.

Fig. 26

SWX IAZI Investment Real Estate Performance Index

For the time being, a low interest rate environment can be assumed. The spread between the distribution yield of Swiss property funds and 10-year Swiss government bonds has reached an all-time high of approx. 3%. In this situation, further investor money is expected to flow into the Swiss property market. At the same time, the supply of existing properties and new construction projects remains limited. The market for multi-family homes nevertheless appears to be bottoming out in terms of initial returns on transactions. In 2019, following ten years of continuous decline, there was even a slight increase.

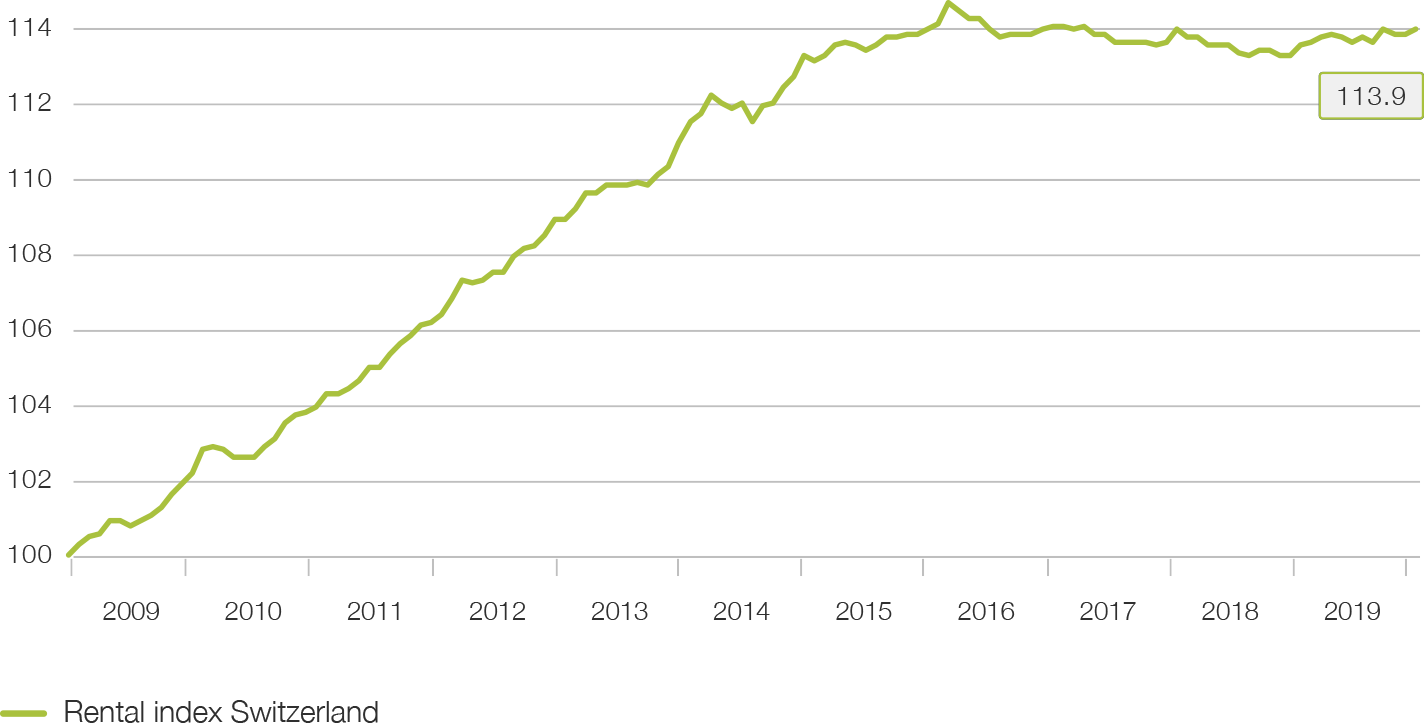

Population growth, the most important determinant of demand for rental housing, is likely to settle at today's level of 0.7 percent in the coming years. There is currently a decline in the number of building applications and building permits for rented flats, but this will only become apparent on the market after a time lag. For the time being, further rising vacancy rates and falling supply rents are to be expected – especially in outlying locations (see Fig. 27). In the big cities, on the other hand, living space remains scarce.

Fig. 27

Development of supply rents for flats

Driven by the increase in jobs, office rents rose slightly last year despite a slightly weaker economy. An increase in employment and thus additional demand for office space is also expected for 2020. Since building applications and building permits for office buildings have been declining for some time, additional supply and demand for new office space will soon be in good proportion again. Outmoded office buildings are becoming more difficult to let.

Caution is advised for retail spaces. On the one hand, high-street trade continues to come under pressure from online retail. The mood of Swiss consumers also remains subdued. The consumer sentiment index is currently slightly below its long-term average. The declining demand for retail space is offset by brisk construction activity, which means that increasing vacancy rates and falling supply rents are to be expected.

In summary, one can say that investments in Swiss property will remain attractive for the foreseeable future. The Swiss property market remains fundamentally well positioned, but is only able to absorb new investments to a limited extent. More than ever, direct investments in property should be made with caution; one should especially carry out a precise analysis of tenant demand in new construction projects at outlying locations. Indirect investments in existing portfolios remain lucrative. Rising interest rates present the greatest risk for the property market.

Sustainability is the property sector’s megatrend

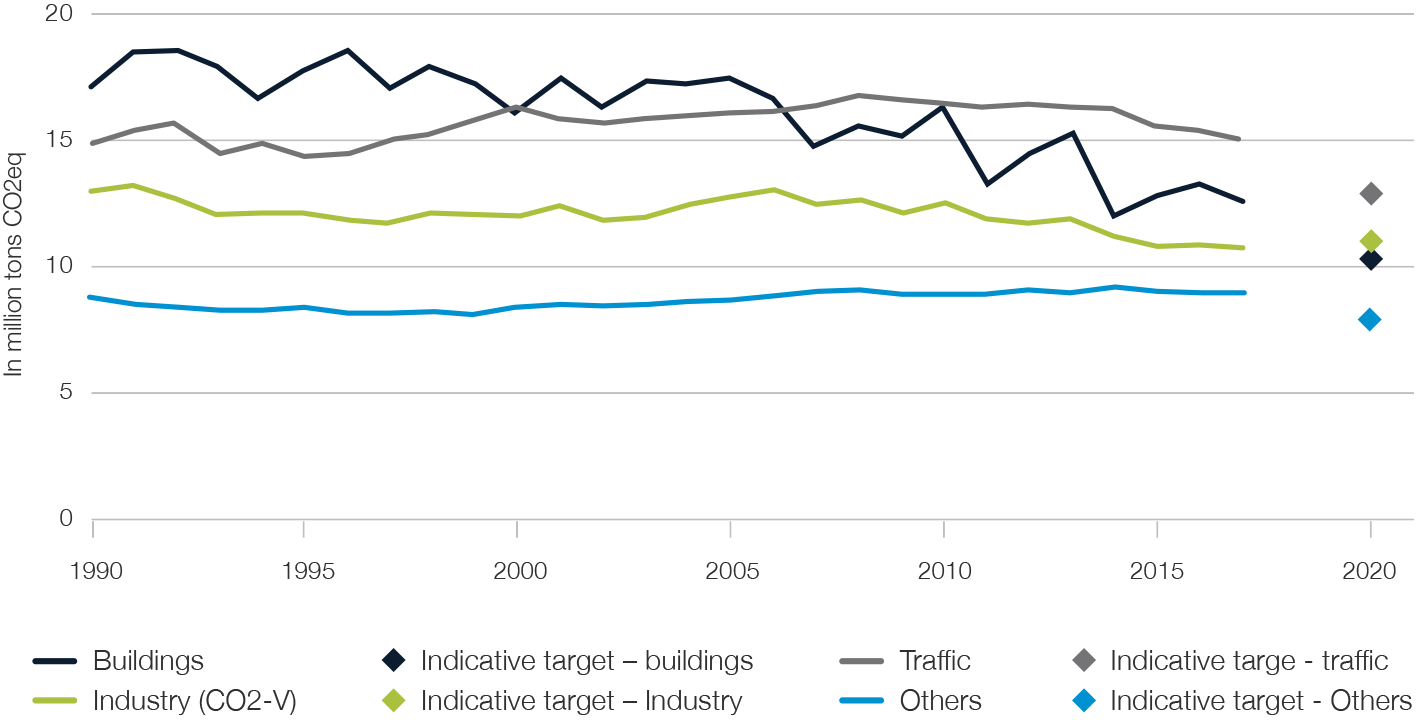

The story of climate protection is a consequence of increasingly ambitious goals. Under the Kyoto Protocol of 1997’s United Nations Climate Convention, Switzerland committed itself to reducing its CO2 emissions to 10% below 1990 levels by 2010. The Swiss CO2 Act was passed to implement it. In the year the law came into force (2000), emissions were 2% lower than in 1990, but ten years later they were 1% higher than in 1990. In 2011, the CO2 Act was revised. The target for 2020 is a 20% reduction in emissions. By 2017, 12% had been achieved, and it is foreseeable that the 2020 target will not be met. With the Paris Climate Protection Agreement of 2015, Switzerland committed itself to halving its greenhouse gas emissions by 2030 compared with 1990 levels. Based on new scientific findings on climate change, the Federal Council decided in August 2019 to tighten this target. The aim is for Switzerland to have balanced emissions levels (net zero emissions) by 2050.

Buildings account for 27% of greenhouse gas emissions in Switzerland. Between 1990 and 2017, emissions from buildings fell by more than a quarter – while the population increased by 26%. None of the other group of emitters can claim such a success. Nevertheless, the interim target of -40% for buildings in 2020 is unlikely to be reached.

Fig. 28

Greenhouse gas emissions by sector

One important instrument of the CO2 Act is the CO2 tax on fuels. This is currently CHF 96 per ton of CO2. According to the proposal currently under discussion in the Swiss Parliament to revise the CO2 Act, the tax is to rise to a maximum of CHF 210. The rate actually collected depends on the degree to which the targets have been met. Two thirds of the CO2 tax flow back to households, which means that the annual additional costs at the CO2 tax’s maximum rate of 210 CHF for the average tenant would in fact amount to about 100 to 150 CHF per year.

The successes to date in reducing climate-relevant emissions from buildings are primarily a reflection of the increasing tightening of regulations on energy consumption in new buildings. According to the latest model regulations, which are currently applied in seven cantons, the energy requirement for heat may not exceed the equivalent of 3.5 litres of heating oil. Compared to the previous regulations, this represents a reduction of 27%. In addition, there are further requirements, in particular for the use of solar energy. This has achieved a high standard for new buildings.

Fig. 29

Development of the limit values for the heating energy demand of residential buildings

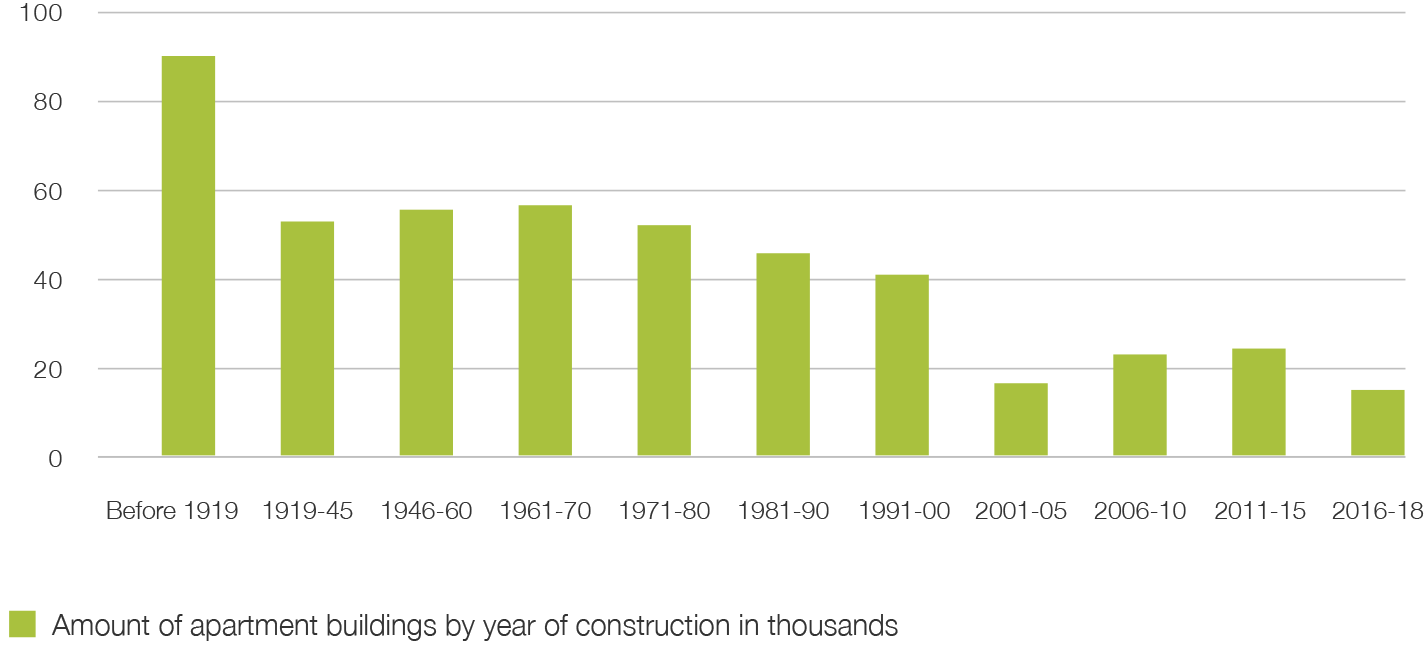

However, three quarters of the buildings in Switzerland are more than 30 years old (see Fig. 30). Many of them have not yet been energetically renovated or have only been partially renovated. This is where the revised CO2 Act will step in. From 2026, a CO2 limit value of 20 kg per square metre will apply for heating system renewals. From 2028, the limit is will be reduced to 15 kg. Old oil or gas heating can then only be replaced with fossil heating if the house is very well insulated.

Fig. 30

Number of multi-family homes by year of construction

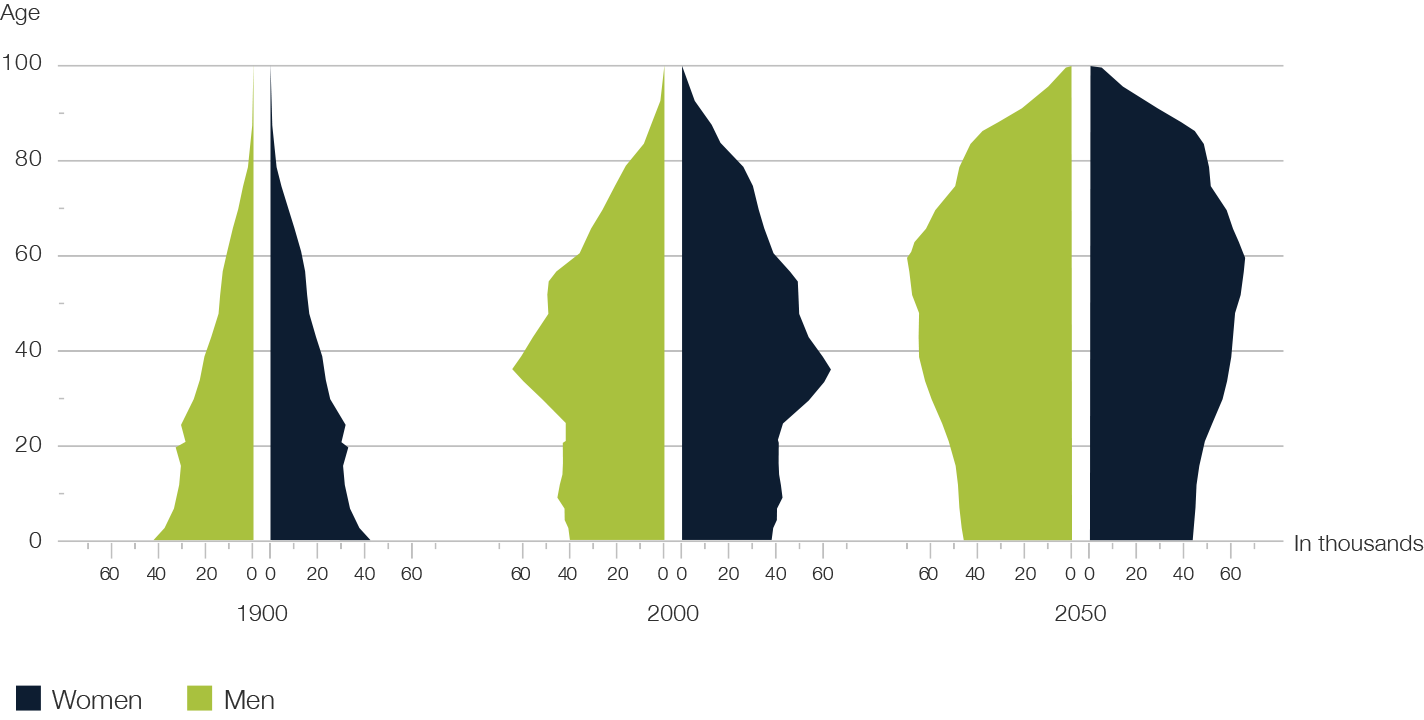

The current climate protection debate sometimes obscures the view of other social issues. The most obvious trend is the ageing population. In the course of the 20th century, the age distribution of the Swiss population changed from a pyramid (1900) to a fir tree (2000). An age structure dominated by baby boomers is typical in Switzerland today. A weaker young generation is facing a growing number of older people. By the year 2050, the fir tree will transform into a beehive (see Fig. 31).

Fig. 31

Development of the age distribution of the Swiss population

This development poses challenges not only to the health care system and old-age provision. The property sector would also do well to begin responding to the consequences of demographic developments today. The effects on housing demand are manifold. One can expect that the demand for smaller flats will increase. People want these to be as well connected as possible to the infrastructure of daily needs, especially shopping, medical care and public transport. In addition, more accessible housing is needed. And in view of further falling conversion rates in the second pillar, housing must remain affordable in old age. This is due to an ever-larger proportion of the population having to contend with stagnating or falling incomes.

What does all this mean for property investors and providers of collective property investment vehicles? To answer this question, it is first necessary to bear in mind that buildings live for a long time. The consequence of this is that around three quarters of 2050’s buildings are already standing today. Accordingly, the property industry is well advised to anticipate foreseeable long-term trends today as far as possible. When it comes to climate protection, the focus for new buildings and the renovation of old buildings should exclusively lie on sustainable energy sources and the use of solar energy. In view of rising energy prices, this also helps to keep the ‘second rent’ in the form of ancillary costs low. In the case of new buildings, the mix of flats (number of rooms per flats) should also take account of expected demand in the longer term. And the rent for a given number of rooms should preferably not be in the upper segment of today's market. Due to the tendency towards rising construction costs (not least because of the stricter energy requirements), the latter can only be achieved through smaller living space. And finally, new buildings should provide reasonable access for the disabled. With good planning, this can be achieved in a largely cost-neutral manner. Building owners and property investment vehicles that act strategically in this sense over the long term are better equipped to meet the challenges of climate and demographic change.

Sustainable Real Estate Switzerland

Sustainable Real Estate Switzerland invests in sustainable property in Switzerland. As a fund not traded on the stock exchange, it is not subject to price fluctuations. It investment focus is on residential properties that meet strict ecological, social and economic sustainability criteria and thus generate attractive long-term returns. The fund offers an attractive performance with an advantageous cost profile.

Key Facts

- Unlisted funds

- Sustainability

- Optimal diversification solution

Factsheets and other documents can be found at picardangst.ch/downloads or directly from your contact person.

Sustainable Real Estate Europe

Sustainable Real Estate Europe invests in sustainable property in promising metropolitan areas in Europe. Its investment focus in this regard lies on office and retail properties that meet strict ecological, social and economic sustainability criteria and thus generate attractive long-term returns. The fund offers stable distributions and low value fluctuations.

Factsheets and other documents can be found at picardangst.ch/downloads or directly from your contact person.

Swiss Development Commercial / Residential

The two investment groups Swiss Development Commercial and Swiss Development Residential invest in attractive property development projects in Switzerland via the Steiner Investment Foundation. They are developed by the renowned Steiner Group, which has already successfully implemented hundreds of such projects. With this tax-privileged solution, Swiss pension funds participate in the development success of valuable Swiss property.

Since its launch at the beginning of 2017, the Swiss Development Residential investment group has consistently outperformed the KGAST residential property index benchmark. Source: KGAST, Steiner Investment Foundation.

Factsheets and other documents can be found at picardangst.ch/downloads or directly from your contact person.

India Real Estate Fund

Picard Angst's India Real Estate Fund focuses on the financing of residential real estate in prime locations in the Indian metropolis of Mumbai. The demand for such property is immense. When selecting projects, the India Real Estate Fund benefits from the profound market expertise of the Steiner Group. The developer, total and general contractor of real estate has already completed more than 1,500 residential and 845 commercial properties in Switzerland and India. The Steiner Group has been part of the Hindustan Construction Company Ltd. since 2010. (HCC) based in Mumbai, India.

Master data

- $ 43 MIO NAV

- RR > 15%

- 6 Ongoing projects

| Investment group | Qualified investors in Switzerland |

| Currency | USD (USD/INR hedging) |

| AIFM & Portfolio Manager | MDO Management Company, Luxembourg |

| Legal form | SICAV |

| Fund structure | Reserved Alternative Investment Fund (RAIF) – closed-end fund |

| Seat | Luxembourg |

| Term | Up to 5 years (2 years extension possible) |

Factsheets and other documents can be found at picardangst.ch/downloads or directly from your contact person.

Share Insight

Important notice

Note that telephone calls on our lines are recorded. By calling us we assume that you agree to your call being recorded. The Swiss Bankers Association’s ‘‘Directives on the Independence of Financial Research do not apply to this presentation. We wish to point out that Picard Angst Ltd. may have interests of its own in the price performance of one or more of the securities described in this document. This document does not constitute an offer or invitation to buy or sell securities. It is intended for information only. All opinions are subject to alteration without prior notification. The opinions expressed here may differ to opinions expressed in other documents published by Picard Angst Ltd. including research publications. Neither the document as a whole nor individual parts of it may be reused or distributed to other parties. Although Picard Angst Ltd. is of the opinion that the information contained in this document is based on reliable sources, Picard Angst Ltd. can accept no liability for the quality, accuracy, current relevance or completeness of this information.

© Picard Angst AG

Regulated by the Swiss Financial Market Supervisory Authority (FINMA).