4. Commodities

Greatest upside potential for precious metals

Dr. David-Michael Lincke, Head of Portfolio Management

In brief

- The late-cyclical economic momentum gave the commodity markets a positive first half of the year with gains in all major commodity benchmarks.

- However, the risks for a continuation of the friendly trend are increasing. Not only have the prospects for the global economy deteriorated further, but the political dispute over the shape of world trade is also threatening to escalate further.

- Nevertheless, there are a number of arguments that continue to support a positive commodities year in 2019. That said, it is advisable to favour commodities facing supply-side bottlenecks or production constraints, as demand-driven commodities and sectors are likely to struggle.

Outlook

After a positive first half of the year on the commodity markets, uncertainty regarding the outlook for the rest of the year has increased significantly. Falling growth and inflation expectations raise questions about the longevity of the commodity cycle. However, bottlenecks in supply and production point to continued potential in agricultural commodities, especially cereals and raw sugar, as well as in the energy sector. In contrast, without an early settlement of the smouldering trade conflict and a brightening of the global economic outlook, base metals are likely to struggle. That said, in view of the turnaround in monetary policy and rising risk aversion on the financial markets, the greatest upside potential is to be found in precious metals.

Comment

Late-cyclical economic momentum gives raw material markets a positive first half of the year

The commodity markets delivered an attractive performance over the first half of 2019. The rise was led by the cyclical sectors of energy and industrial metals. This largely offset the sharp correction suffered by the commodity markets in the previous year. The weak performance in the second half of the previous year was particularly disappointing, as the late-cyclical expansion phase of the global economy currently offers a favourable economic environment, which in the past was accompanied on average by particularly high commodity returns.

The rapid recovery that has now taken place reinforces our view that the sharp price correction should not be seen as a harbinger of the end of the commodity cycle, but merely as an intermediate correction. To a large extent, this could be attributed to exogenous factors of a political nature (US-China trade conflict, sanctions and antitrust policy in the energy sector) rather than a lack of constructive fundamental data in the individual commodity sectors.

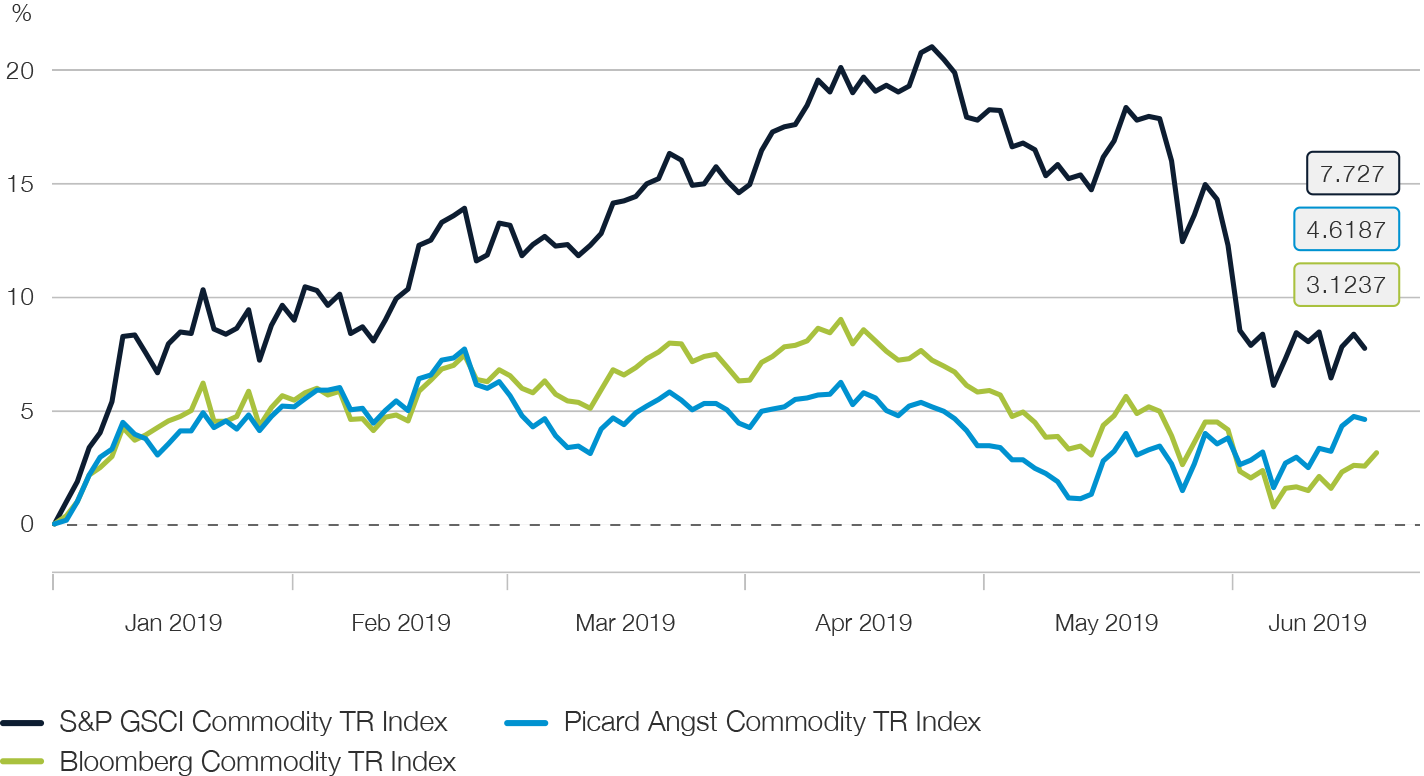

The leading role played by the energy sector in the recovery of commodity markets favoured strategies with a pronounced cyclical profile. Accordingly, among the broad commodity benchmarks, the extremely energy-heavy S&P GSCI Commodity TR recorded by far the highest gain with a return, even though the correction of the oil price in the middle of the year significantly reduced the degree of outperformance. More balanced benchmarks such as the Bloomberg Commodity TR Index rose more moderately. Despite its comparatively less–cyclical sector profile and the initially weaker development of the agricultural sector, our in-house PACI strategy (investable via our fund product Picard Angst All Commodity Tracker Plus) managed to beat the benchmark Bloomberg Commodity TR (see Fig. 24).

Fig. 24

Picard Angst Commodity TR vs. Benchmark Indices 2019

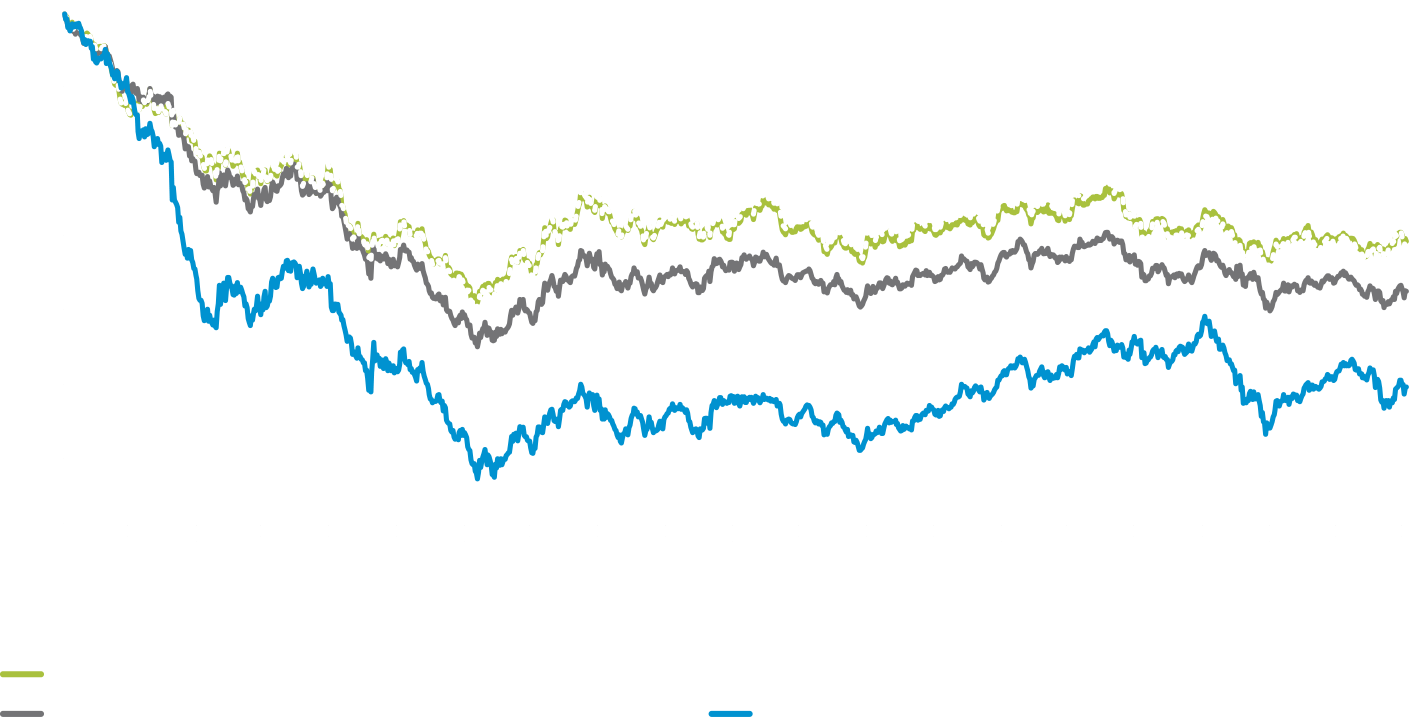

Thanks to their concentration on predominantly cyclical sectors, yields were particularly high in those strategies that did not take agricultural commodities into account. In this category, our Picard Angst Energy & Metals strategy (can be invested via our fund product Picard Angst Energy & Metals) clearly outperformed the benchmark Bloomberg Commodity ex-Ag ex-LS TR.

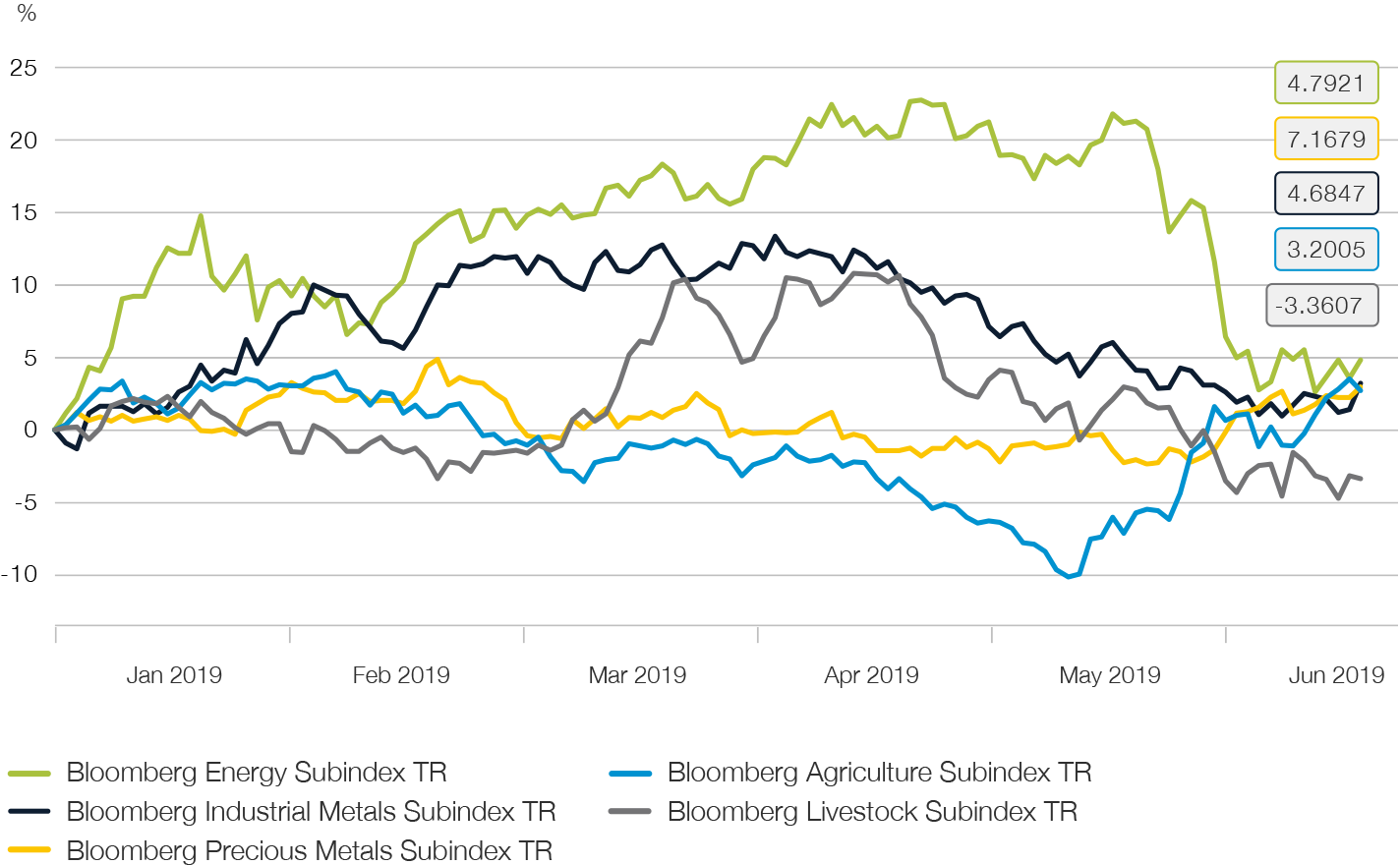

Fig. 25

Development of commodity sectors in 2019

The economic risks are increasing. However, there are still strong arguments in favour of the rebound continuing on the commodity markets

In the past, commodity prices experienced the biggest appreciation and outperformed other asset classes when the economic cycle had already peaked, resource shortages were felt and central banks began to hit the brakes. In particular, the pronounced outperformance in the late cyclical expansion phase can be explained by the fact that commodity prices are determined by the supply and demand situation on the spot market – unlike financial equities such as shares, which discount future growth and cash flows. Prices thus rise when the current level of demand exceeds available supply.

Even if leading indicators indicate an increasing weakening of the global economy, the current level of activity remains robust and the global economy remains on course to expand by at least 3% in the current year. The development of commodity prices is primarily determined by the current level of activity and not by the anticipated future path of growth. As long as demand outweighs supply, positive returns can generally be expected.

The sharp correction in commodity prices at the end of the previous year created good conditions for a substantial recovery. However, uncertainty about the economic outlook has also increased significantly. This is likely to be reflected in an increasing dispersion of yield development between sectors and individual commodities over the course of the year. In particular, preference should be given to commodities that are confronted with supply-side bottlenecks or production restrictions, while demand-driven agents may have to struggle. This speaks for positive return prospects, especially for agricultural commodities but also for the oil complex. However, caution is required with base metals and natural gas. In addition, falling real interest rates and rising risk aversion point to upward potential for precious metals.

Alongside economic factors, however, the importance of favourable political conditions must not be overlooked. The intensification of the trade conflict between the United States and China has increased the political risks.

The expectations we formulated at the beginning of the year, that annual returns for our in-house commodity investment strategy would be between 10 and 15 percent, presuppose that a further escalation will be avoided and that an amicable agreement will be reached in the coming months.

In detail, the following factors in particular will likely continue to support commodity markets:

The sharp decline in capital expenditures and investments in new production capacities since the global financial crisis is increasingly becoming a limiting factor in meeting rising demand.

The majority of the most traded commodities now have declining inventory turnover rates and thus supply deficits. The reduced availability of commodities also has an impact on the maturity structure. For example, the forward curves in the energy sector have inverted significantly and flattened out for individual base metals and agricultural commodities. The roll yield profile for investors is thus materially improved.

The US Federal Reserve's leading role in the normalisation of monetary policy was reflected last year in a substantial appreciation of the US dollar on a trade-weighted basis. It is now clear, however, that the US key interest rate cycle has already passed its peak. A gradual weakening of the dollar is therefore to be expected for the rest of the year, which will have a tailwind effect on the commodity markets.

With the deterioration in sentiment towards the end of last year, investor exposure to the commodity markets has also declined significantly. Substantial capital outflows have brought the net positioning of financial investors to the lower end of the historical range. In the past, this investor positioning data has proven to be a useful counter-indicator, as extreme values have often preceded trend reversals.

The return on collateral yield has recovered noticeably over the past year by more than one percentage point and currently stands at over 2% p.a.

Over the past year, commodities in a mixed portfolio have not had the expected diversifying effect. However, should political factors recede into the background, it can be expected that they will re-establish the regime of low correlation of previous years with equities and bonds. The correlations between the individual commodity sectors continue to move towards zero.

The risks that could jeopardise our positive scenario for the commodity markets include the following:

The global slump in inflation expectations is cause for concern. On the one hand, this is a further indicator of a slowdown in the global economy and, on the other, unexpected inflation is a primary driver of commodity prices.

The escalation of the smouldering trade dispute between the United States, China and the EU into an all-out trade war could torpedo the growth of the world economy and severely affect demand for commodities. On the other hand, should the impact of new tariff barriers be limited, the resulting friction and increased production costs will tend to be reflected in rising commodity prices.

Economic momentum in China has been much more severely affected by the consequences of the trade conflict than the US economy. A significant further cooling of the Chinese economy would have far-reaching effects on the energy, metal and agricultural markets. However, China has already introduced far-reaching fiscal and monetary policy measures to stimulate the economy. Their effect should become increasingly apparent over the coming months and – if successful – keep growth above the six percent mark in 2019.

Energy

In response to the sharp price correction in the oil complex towards the end of last year, the OPEC cartel and Russia decided to introduce new production cuts. As a result of the measures taken on the production side and sustained growth in energy demand, global oil reserves have begun to shrink again. This is also reflected in the forward curves of the benchmark oil grades, which have inverted again and thus promise positive rolling returns to investors in backwardation.

At the same time, however, production growth in the American shale oil sector continues unabated. While the additional supply in the first quarter was absorbed by robust consumer demand, US stockpiles are now rising sharply again. However, the decline in exploration activity since the beginning of the year (measured by the rig count) as well as corresponding forecasts by the EIA give hope that the growth rate of production will decline in the course of the year, especially as investors in this sector are increasingly insisting on discipline and profitability being given priority over growth.

In the meantime, however, since Brent crude oil significantly exceeded our price target of USD 70 per barrel in May, uncertainty about the fundamental condition and outlook of the global oil market has increased significantly. Factors that limit supply, such as the contamination crisis of the Russian export pipeline system and the US sanctions against Iran and Venezuela, have receded into the background and market participants have turned their attention to the gloomy outlook on the demand side of the market against the backdrop of declining economic indicators and the intensification of the US-China trade conflict.

However, the fact that the price correction of recent weeks was not accompanied by an easing of the supply situation on the physical oil market and that the inversion of the forward curves, especially at the short end, has not abated, makes a sustained correction unlikely, at least in the short term. In addition, there are many indications that OPEC and Russia will soon agree on an extension of the current production cuts until the end of the year. This should contribute to a recovery and stabilisation of price developments. However, with no signs of a turnaround in the economic outlook, a lasting return to Brent prices above USD 70 per barrel cannot be expected for H2 2019.

Industrial metals

Many base metals are in a fundamentally encouraging condition. Sector-wide robust growth in demand contributed to a gradual reduction in inventory turnover rates on the futures exchanges. This has also increasingly been reflected in the forward curves. Alongside zinc, copper has thus turned into backwardation, and the term structure of aluminium, lead and nickel has flattened out. Production costs have also risen in various ways, for example in the case of aluminium, where the input factor of alumina has become significantly more expensive due to a shortage of supply. Nickel is increasingly becoming the focus of attention due to its potential for the production of batteries for electric vehicles. According to analyst estimates, the amount of nickel required for battery production will increase tenfold over the next eight years.

While the sector recorded a significant recovery in prices in the first quarter against this backdrop, the escalation of trade conflict in the middle of the year has already caused it to evaporate. Given the sector's high dependence on demand and the central role of China as the largest consumer and producer of industrial metals, a resumption of the recovery trend will require not only a solution to the political problems, but also signs that the economic outlook is stabilising.

Furthermore, it can be assumed that the prospects for the individual metals will diverge significantly in terms of their supply dynamics. The decisive factor here is whether the supply cycle is dominated by long-term or short-term factors. The medium- and long-term prospects for copper remain positive, as the slump in capital investments since 2013 has brought the supply growth phase to an end and the development of new production capacities is subject to long lead times. In contrast, the aluminium market is likely to face a headwind. The availability of raw materials and the input factor of energy is not limited. However, the supply-side reforms and new environmental requirements in China have cemented higher cost structures, which will prevent prices from falling back to 2016 levels.

The long-term prospects for base metals remain extremely positive. The mining industry is only slowly moving away from a record low in profit margins, which fell to their lowest level since 1998 in 2016. In the past, they proved to be a reliable indicator for the development of the market balance with a delay of about two years. This suggests that the sector will continue to recover in the coming years as supply deficits increase.

Precious metals

Last year, the precious metals sector was particularly characterised by a lack of sustained demand for gold as a safe haven. The negative investor sentiment not only became extreme with regard to gold but also with regard to other monetary precious metals such as silver and platinum, meaning that the number of short positions in the futures markets for gold, i.e. bets on falling prices, reached record levels, while long positions betting on rising prices reached a multi-year low.

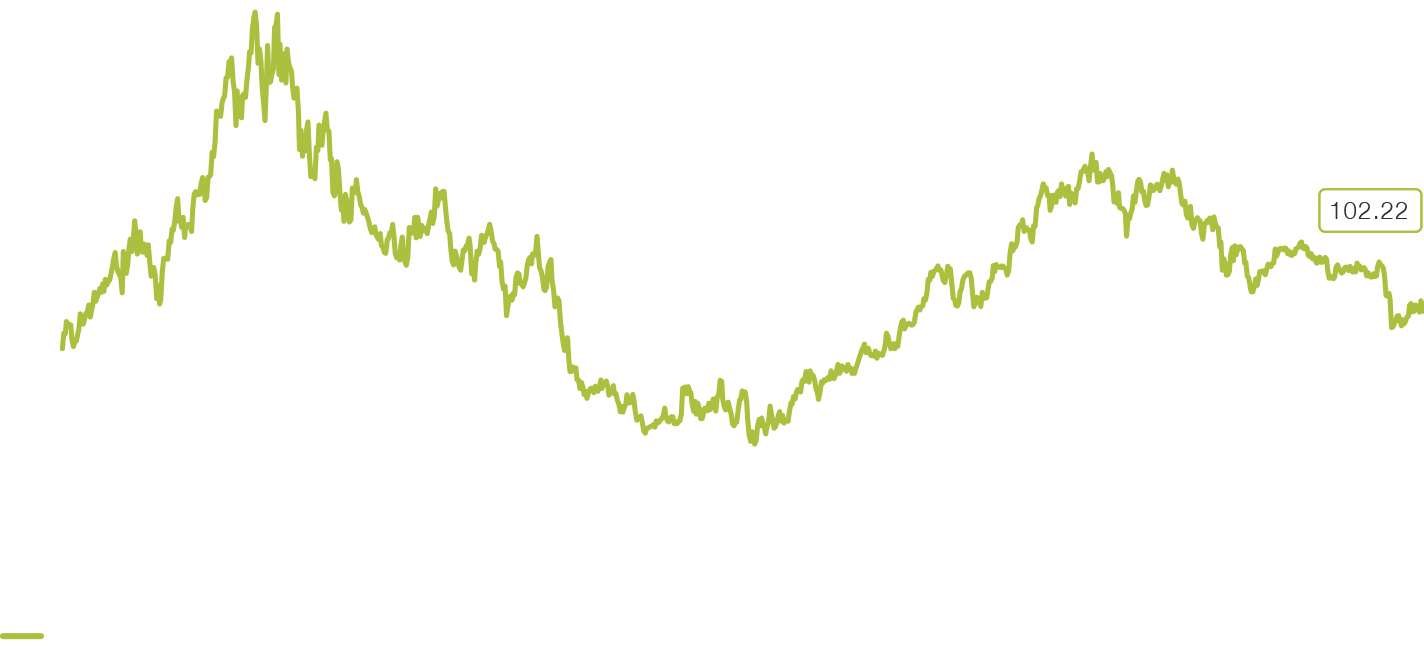

But extremes in investor sentiment and positioning are often harbingers of a turning point for the trend. And the mood of market participants in the precious metals sector has thus fundamentally changed compared to the previous year. The turnaround in central banks worldwide away from normalisation of monetary policy towards renewed easing has made a major contribution to this. As a result, long-term real interest rates in the dollar zone, one of the primary determinants of the gold price, have begun a sustained downward trend. This helped the gold price to break above USD 1,400 per troy ounce, which means that our price target was already reached before the middle of the year.

Over the past five years, the gold price has been trapped in a broad sideways movement between USD 1,050 and USD 1,380 per troy ounce. Now that gold has managed to break out of this range, there is a good chance that the upwards trend will continue. Factors that drove the last long-term rise in the gold price are once again coming to the fore. They include:

Robust physical demand: The demand for physical gold, traditionally dominated by China and India, is beginning to rise significantly again. Central banks are also increasingly acting as buyers again and already increased their purchases by 22% in the previous year.

Devaluation of the US dollar: Instead of further interest rate hikes, the US Federal Reserve now expects up to three rate cuts by the end of the year. At the same time, the monetary policy scope of the central banks in Europe, Great Britain and Japan is limited. This should contribute to a gradual depreciation of the dollar in the second half of the year

Increasing economic and financial market risks: Increasing concerns about the outlook for the global economy, geopolitical conflicts and stability risks in view of the historically high leverage of corporate balance sheets should sustainably increase the demand for gold to hedge portfolios.

Against this backdrop, and in view of investors' still comparatively moderate positioning, we expect gold's upward trend to continue in the second half of the year at around USD 1,500 per troy ounce.

Fig. 26

Falling real interest rates fuel rising gold prices

Agricultural commodities

In addition to base metals, agricultural commodities have felt the effects of the ongoing trade conflict between China and the United States most severely. The result was a noticeable decline in participation in the futures markets for agricultural goods. US soya beans were hit hardest in the price formation, with China reducing a previously used export share of more than 60% to zero. However, the prices of other major US futures contracts on cereals and soft commodities such as cotton also suffered significantly. This development is particularly lamentable for financial investors, who, due to liquidity and market access requirements, are dependent on the contracts of the major US futures exchanges and are generally unable to switch to local markets that are not affected or are benefiting from the situation, for example, for soy beans in South America.

For most of the first half of the year, agricultural commodities, in particular cereals, recorded a disappointing price trend. In contrast to other asset classes, high expectations of an amicable settlement in the near future were never priced in. Similarly, latent weather risks were neglected until they began to crystallise in May. Extensive flooding in the midwestern United States has led to massive delays in sowing corn, soybeans and wheat. There are now signs of a significant reduction in acreage, which will result in a much stronger than expected reduction in inventories and a dramatic turnaround in grain prices on the futures markets, which could continue in the second half of the year.

Among soft commodities, the outlook is positive, especially for the sugar market. This is because the supply and demand balance for raw sugar is moving into an increasing deficit. The prospect of a potential return of the El Niño weather phenomenon in the third quarter, which increases production risks, is likely to increase volatility.

Picard Angst All Commodity Tracker Plus

Broadly diversified and systematic investment strategy for commodities in a Swiss fund vessel, which is characterised by a transparent construction method. Thanks to its advantageous return and risk profile, it is an attractive alternative to the relevant commodity benchmarks.

Source: Bloomberg LP

Factsheets and other documents can be found at picardangst.ch/downloads or directly with your contact person.

Picard Angst Energy & Metals

Broadly diversified and systematic investment strategy for commodities. The focus on energy and metals excluding agricultural commodities creates a particularly cyclical profile. Thanks to its transparent design and advantageous return and risk profile, this fund is an attractive alternative to the relevant commodity benchmarks.

Source: Bloomberg LP

Factsheets and other documents can be found at picardangst.ch/downloads or directly with your contact person.

Picard Angst Systematic Commodity Alpha

This investment strategy opens up various alternative risk premiums on the commodity markets on the basis of a market-neutral quantitative approach. Irrespective of the development of the broad commodity markets and the traditional asset classes, positive returns are generated in the medium and long term even with moderate volatility.

Source: Bloomberg LP

Factsheets and other documents can be found at picardangst.ch/downloads or directly with your contact person.

Share Insight

Important notice

Note that telephone calls on our lines are recorded. By calling us we assume that you agree to your call being recorded. The Swiss Bankers Association’s ‘‘Directives on the Independence of Financial Research do not apply to this presentation. We wish to point out that Picard Angst Ltd. may have interests of its own in the price performance of one or more of the securities described in this document. This document does not constitute an offer or invitation to buy or sell securities. It is intended for information only. All opinions are subject to alteration without prior notification. The opinions expressed here may differ to opinions expressed in other documents published by Picard Angst Ltd. including research publications. Neither the document as a whole nor individual parts of it may be reused or distributed to other parties. Although Picard Angst Ltd. is of the opinion that the information contained in this document is based on reliable sources, Picard Angst Ltd. can accept no liability for the quality, accuracy, current relevance or completeness of this information.

© Picard Angst Ltd.

Regulated by the Swiss Financial Market Supervisory Authority (FINMA).