Responsible Finance

Mit systematischen Anlagestrategien nachhaltig Wert schaffen und die Zukunft gestalten. Picard Angst. Schweizer Finanzdienstleister. Unabhängig und inhabergeführt. Erfolgreich seit 2003.

ESG Competence Center

Events

Krypto-Chancen für institutionelle Investoren. Praxisnaher Zugang mit AMCs.

Viele institutionelle Investoren, darunter auch Pensionskassen, nähern sich dem Thema Kryptowährungen. Der Druck zur Diversifikation und zur Erschliessung neuer Anlagechancen steigt.

Lunch-Event: Food Innovation zwischen Gesundheit, Kosten und Regulierung

Zur Präsentation

Webinar – Logistik Food Park Kerkrade I & II

Video ansehen

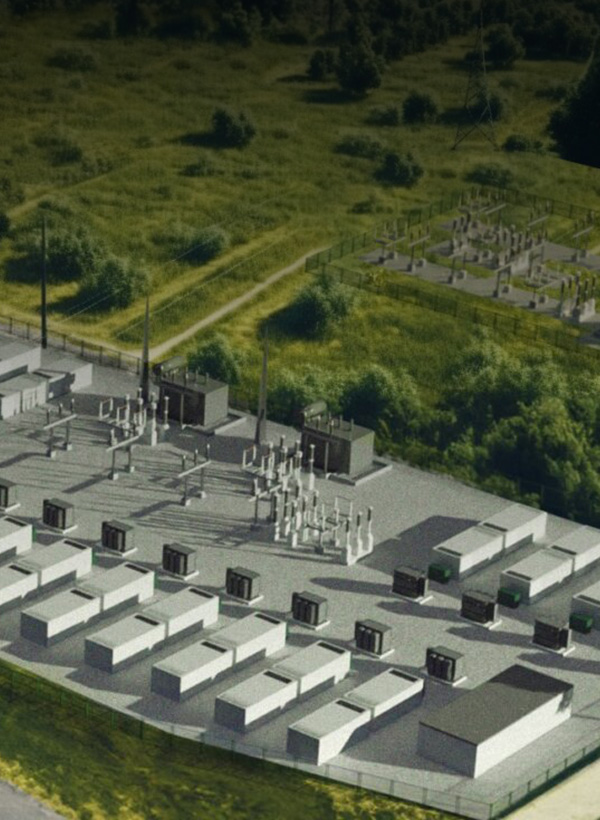

Batteriespeicher als Investmentchance

Zur Präsentation

Traditionelle Werte. Schweizer Stärken. Nachhaltige Zukunft.

Über uns

Unabhängigkeit, Kompetenz und Innovation: Auf der Verbindung traditioneller Werte mit Schweizer Stärken beruht der langjährige Erfolg von Picard Angst.