Responsible Finance

Creating sustainable value with investments and shaping the future. Picard Angst. Swiss financial services provider. Independent and owner-managed. Successful since 2003.

ESG Competence Center

Events

Crypto Opportunities for Institutional Investors. A Practical Approach with AMCs

Watch video

Lunch Event: Food Innovation between Health, Costs, and Regulation

To the presentation

Webinar – Logistics Food Park Kerkrade I & II

Watch video

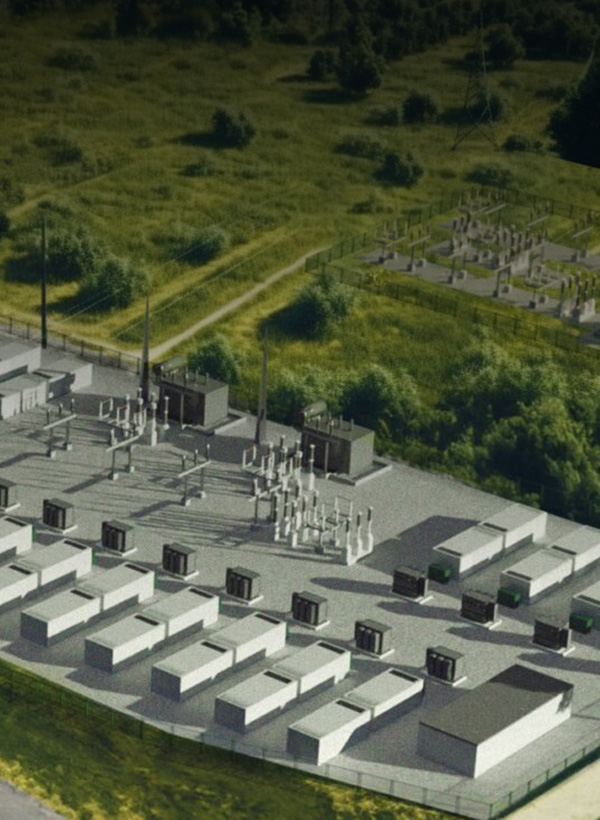

Battery Storage as an Investment Opportunity

To the presentation

Traditional values. Swiss strengths. Sustainable future.

About us

Independence, expertise and innovation: Our unique combination of traditional values and Swiss strengths is the secret to our long history of success.