Picard Angst introduces a Swiss ISIN solution offering equal-weighted exposure to BTC, ETH & SOL, daily dealing/valuation as per the product documentation, and hybrid subscription in fiat or crypto – all within a Swiss banking and custody framework. Subscribe via your custodian bank; no investor wallet required.

Why now - institutional exposure without the operational drag

Institutional demand has moved from pilots to mandates. What’s required is regulated, process-conforming access that plugs into existing custodian-bank and ISIN workflows, reporting and oversight — without wallets or operational friction. An equal-weighted large-cap allocation offers a balanced, transparent entry that is simple to explain and supervise.

What you get with Picard Angst

- Equal-weight BTC / ETH / SOL 1:1 participation; quarterly rebalancing.

- Swiss ISIN access & daily liquidity — subscribe via your custodian bank; no investor wallet required.

- Hybrid subscription – fiat or crypto; USD/CHF (hedged) tranches available.

- Custody in Switzerland — segregated custody with a FINMA-regulated bank.

- Optional CO₂ offset on request.

Swiss governance and execution, so digital assets fit seamlessly into institutional processes.

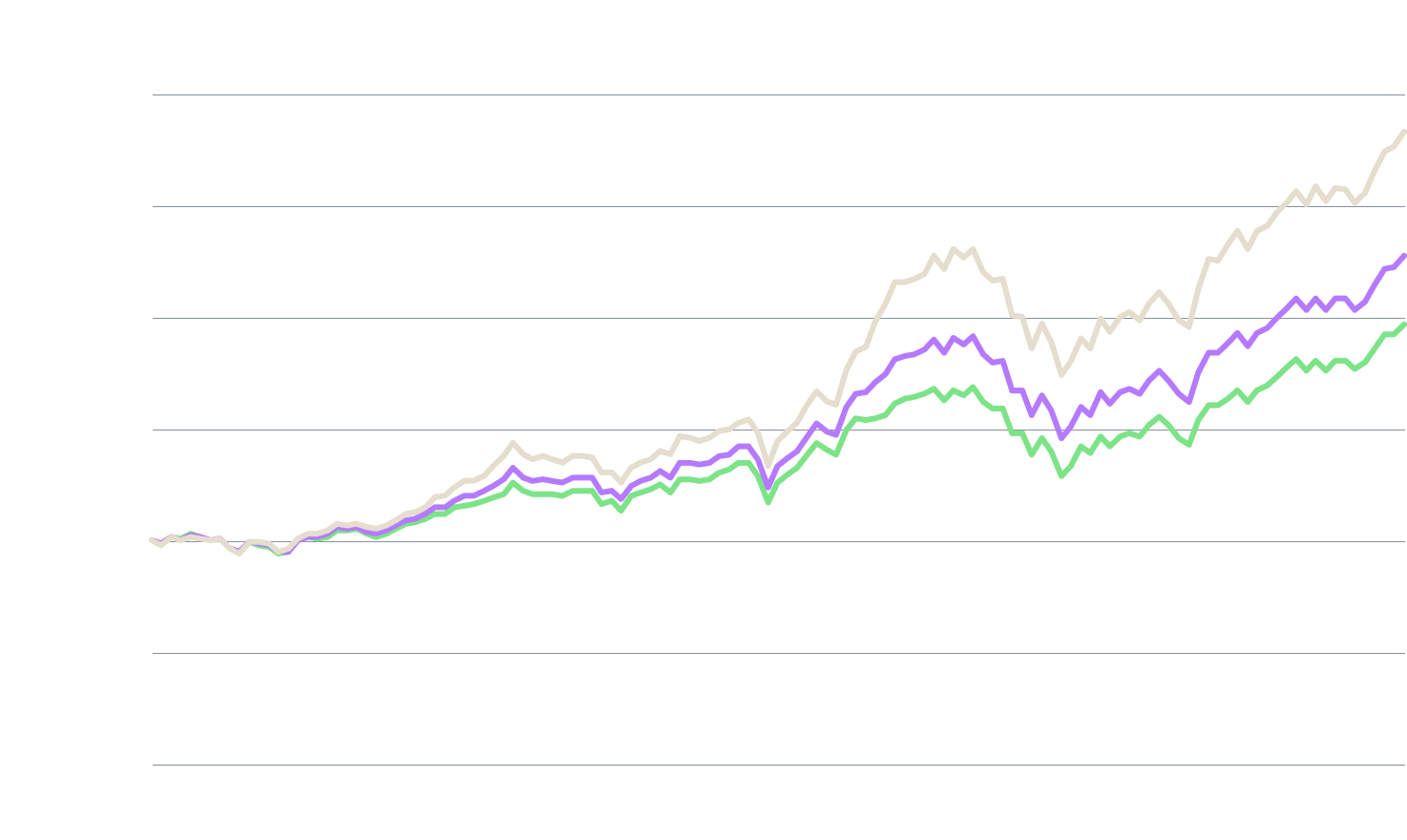

Portfolio Context: Added Value through Diversification

With an allocation of just 1% to the Picard Angst Crypto AMC: +1.42% p.a. higher return with unchanged volatility – resulting in a higher Sharpe Ratio for the overall portfolio (in CHF).

Portfolio Performance (Quarterly Rebalancing) in USD

-

USD: 60% Eq, 40% Fi

-

USD: 59% Eq, 40% Fi, 1% BTC/ETH/SOL

-

USD: 57.5% Eq, 40% Fi, 2.5% BTC/ETH/SOL

Portfolio Performance (Quarterly Rebalancing) in CHF

-

CHF: 60% Eq, 40% Fi

-

CHF: 59% Eq, 40% Fi, 1% BTC/ETH/SOL

-

CHF: 57.5% Eq, 40% Fi, 2.5% BTC/ETH/SOL

Data as of August 2025

Equities: MSCI ACWI Index

Bonds: Bloomberg Global-Aggregate Total Return Index

Performance of ETH included from June 30, 2017

Performance of SOL included from June 30, 2020

How it works — from subscription to reporting

-

No issuer recourse

assets are held in segregated SPV compartments (separate estates) -

1:1 backing

BTC, ETH and SOL are backed 1:1 vs. the AMC’s NAV, as set out in the product documentation -

Custody in Switzerland

segregated, off-balance-sheet custody with a FINMA-regulated bank