Infrastructure – Build on Stability and Growth

The urgent renewal and expansion of infrastructure requires investments worth trillions of Swiss francs. With our infrastructure solutions you can tap into the trends that are shaping tomorrow’s world – combining sustainable growth with stable returns.

Webinar

11.00 am / Teams – Live Events

Necron Bond: TIMBERWORKS LOGISTICS CENTER Logistics Hub

Picard Angst’s ESG Competence Center is expanding its bond infrastructure program with a sustainable bond for the TIMBERWORKS LOGISTICS CENTER logistics hub. In our webinar, Daniel Gerber, Chief Sustainability Officer at Picard Angst, and Martin Jäger, Finance & Investments at our partner Necron, will present this investment opportunity and provide an overview of the structure, key terms, and main highlights.

Daniel Gerber

Head of Market Switzerland & Chief Sustainability Officer

Insights

Opportunities for infrastructure investments

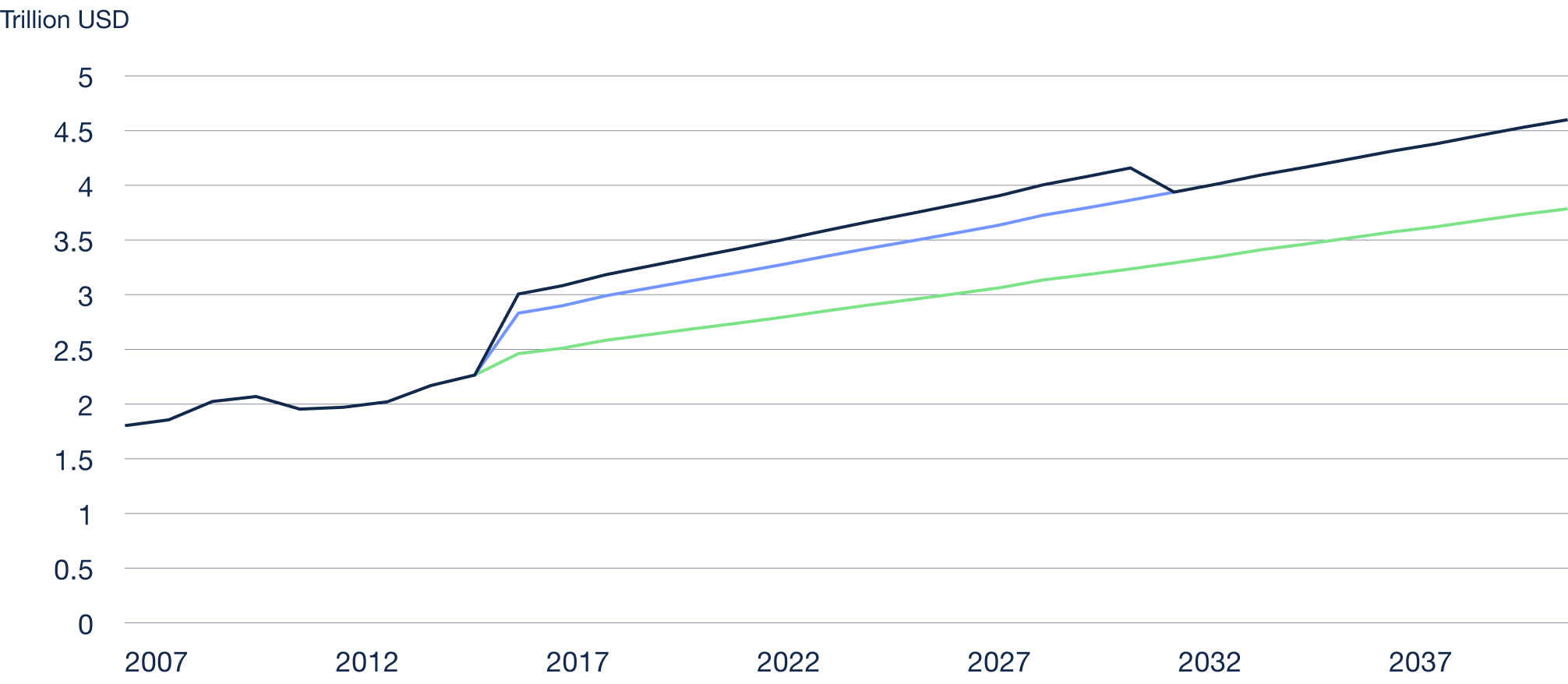

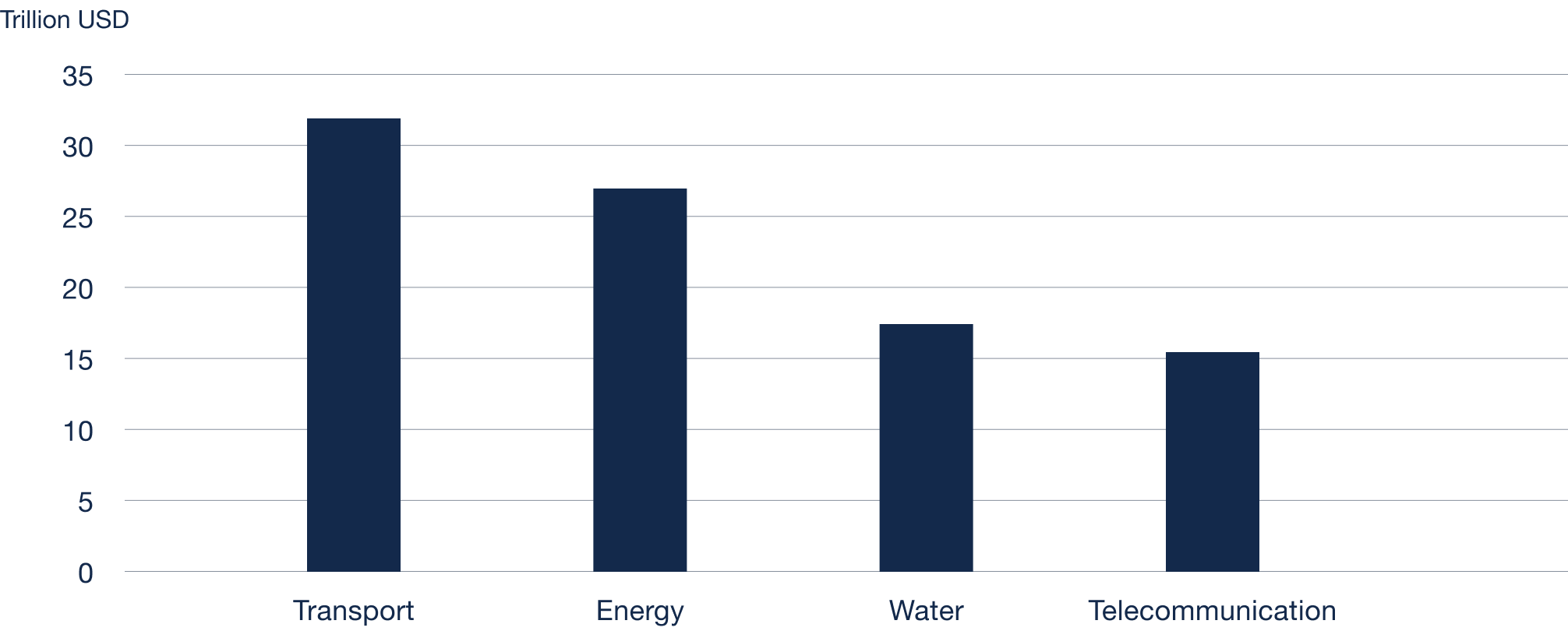

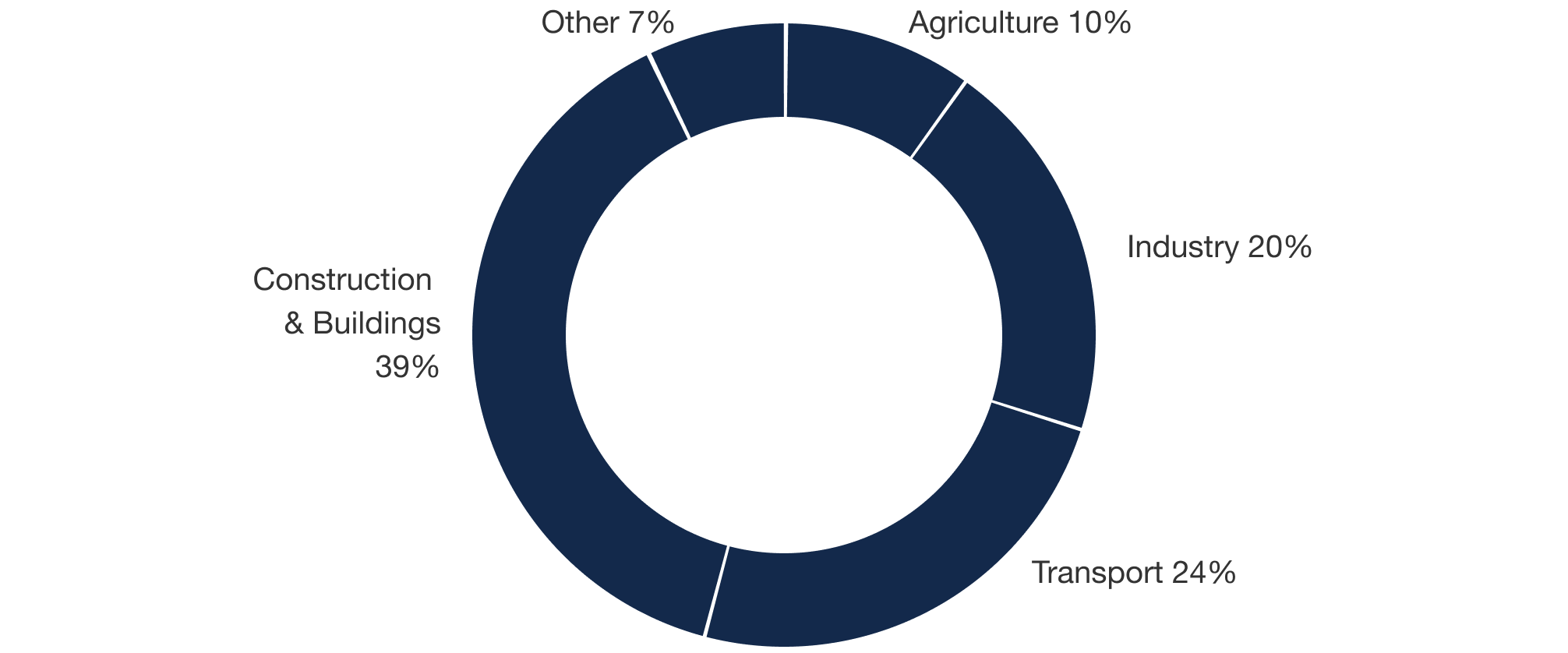

Infrastructure is the backbone of every economy and the key to meeting critical sustainability and supply‑security goals. Decarbonization, digitalization and demographics are creating substantial financing gaps, paired with stable, real‑economy‑backed return prospects. The following sub‑themes show how institutional investors can position themselves strategically.

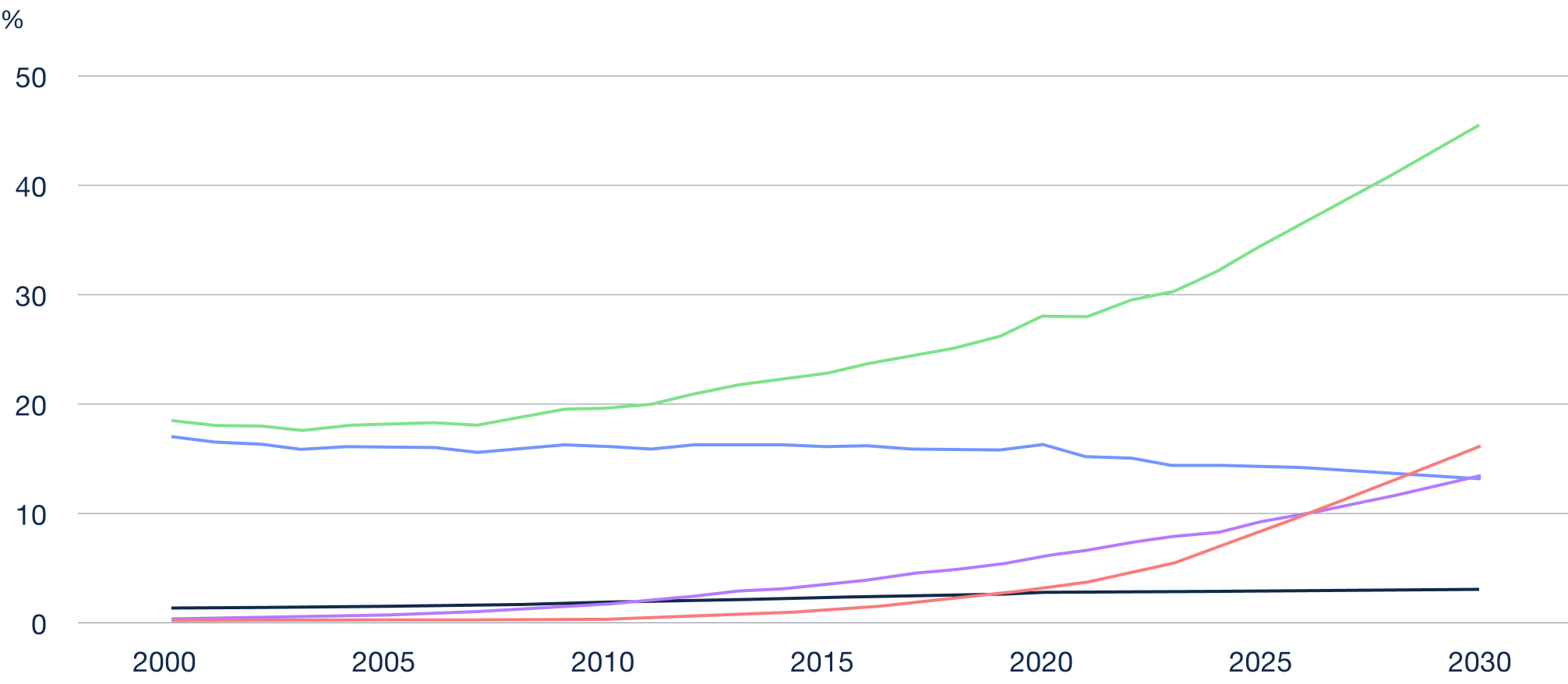

Renewables Demand Massive New Infrastructure

Electricity demand will more than double by 2050. Renewable energy—especially wind and solar—will form the backbone of future infrastructure, requiring extensive upgrades to grids, storage and back‑up systems.

In Brief

- Participation in large‑scale wind and PV projects

- Investment in grid stability and system integration

- Long‑term cash flows via PPAs and government‑supported markets

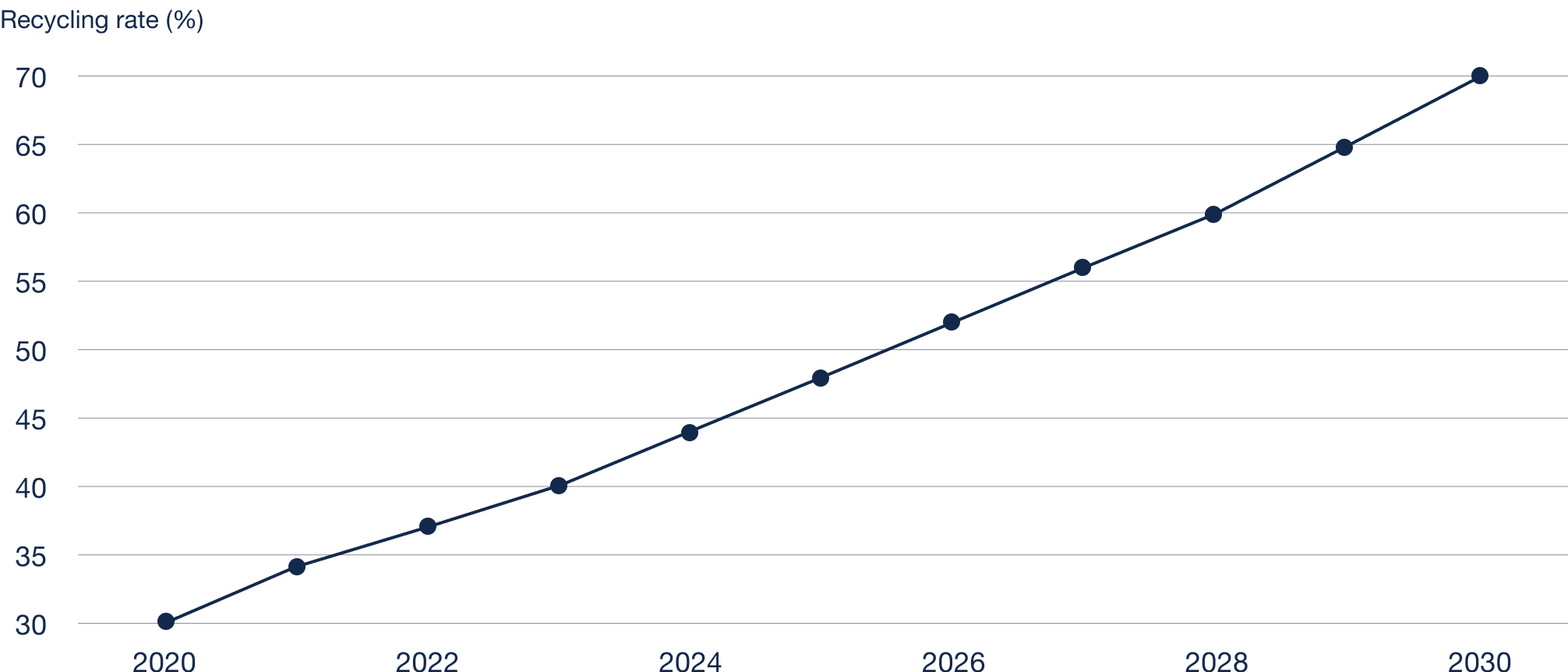

Recycling Unlocks New Value

Efficient material recovery is a pivotal lever for sustainable supply security. Dynamic markets are emerging in PET recycling, supported by regulatory mandates.

EU PET Recycling Rate (2020 – 2030)

Source: PET Market in Europe – State of Play 2022, EU Packaging & Packaging Waste Directive

In Brief

- Financing sorting and recycling facilities

- Participation across the PET value chain (collection, processing, resale)

- Project partnerships with government rebates

The Backbone of Freight

EU policy aims to shift freight to rail, boosting demand for low‑emission rolling stock—from electrified locomotives to modern wagons.

In Brief

- Long‑term leasing and pooling models for rolling stock

- Stakes in vehicle manufacturers and operator consortia

- Subsidized projects with ESG classification

Re‑Regionalization Creates New Demand Hubs

Pandemic disruptions, geopolitical tension and ESG‑driven consumption have reshaped global supply chains. Regional, highly automated logistics hubs near consumer centers – especially in Europe – are now in focus.

Amsterdam’s metro area, with direct airport links, multimodal logistics and thriving e‑commerce, ranks among Europe’s most sought‑after corridors. Modern, ESG‑compliant warehouse space with long leases offers stable yields and strong secondary‑market appeal.

In Brief

- Investments in logistics developments via forward sales or long‑term holds

- Stable rental income from global logistics operators

- ESG certifications (e.g. BREEAM) as yield and reputation advantages

Securing Provision, Stabilizing Society

Demographic shifts are reshaping cities and driving demand for integrated health, care and education facilities. Urban areas are seeing new forms of social infrastructure mixed‑use campuses, health parks and hybrid care quarters.

High base‑level demand and stable tenancy often with public‑sector backing make social infrastructure a preferred field for long‑term investors. ESG goals can be met through measurable impact, social inclusion and energy efficiency.

In Brief

- Stakes in urban health and care campus projects

- Stability through long‑term contracts with healthcare providers or municipalities

- Combining social impact with income‑stable real‑estate backing

Investment solutions

Energy transition, decarbonization, digital transformation – infrastructure lets you build on sustainable performance.

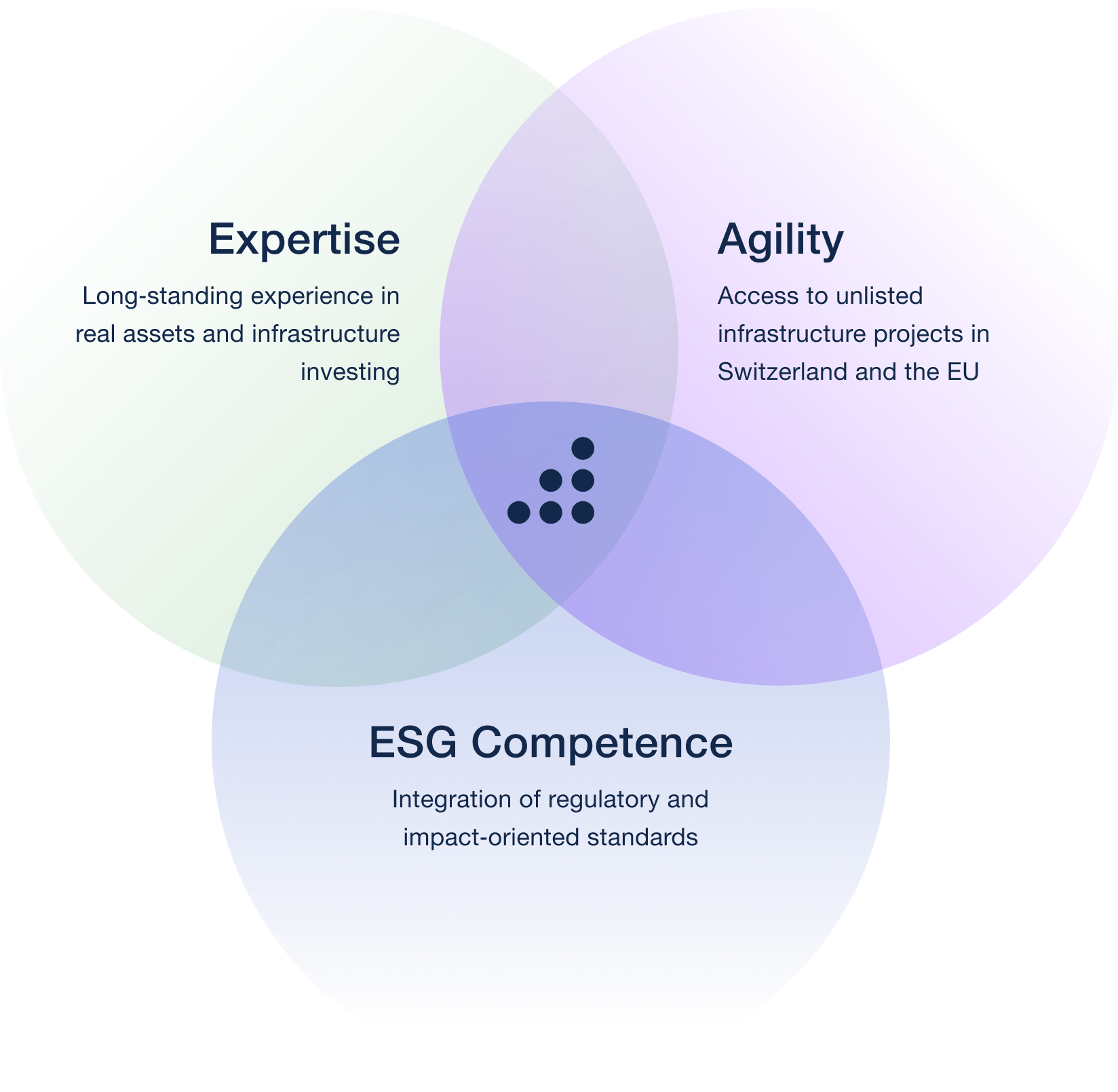

Trust in us