Commodities – 360° Expertise for Your Commodity Strategy

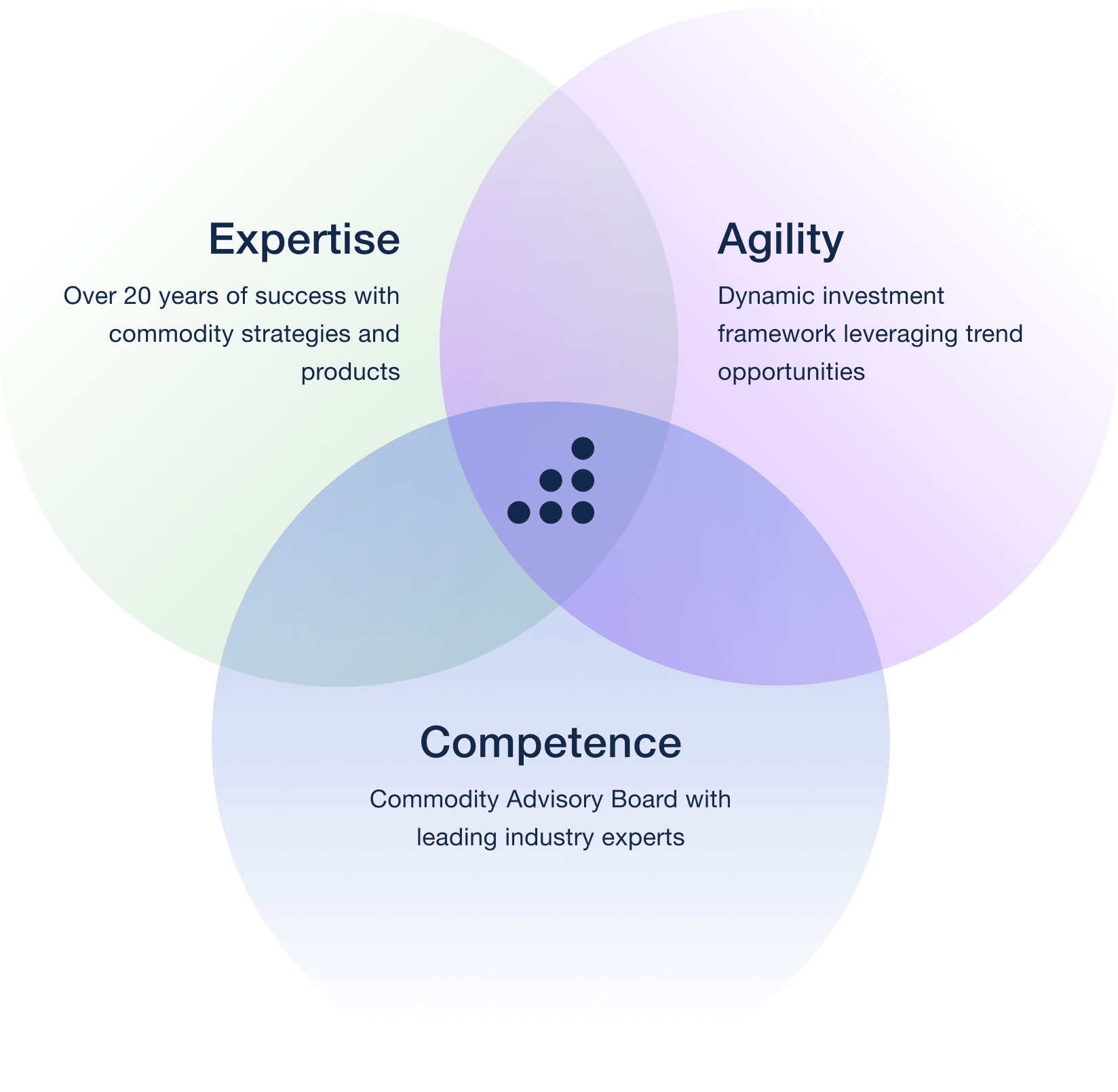

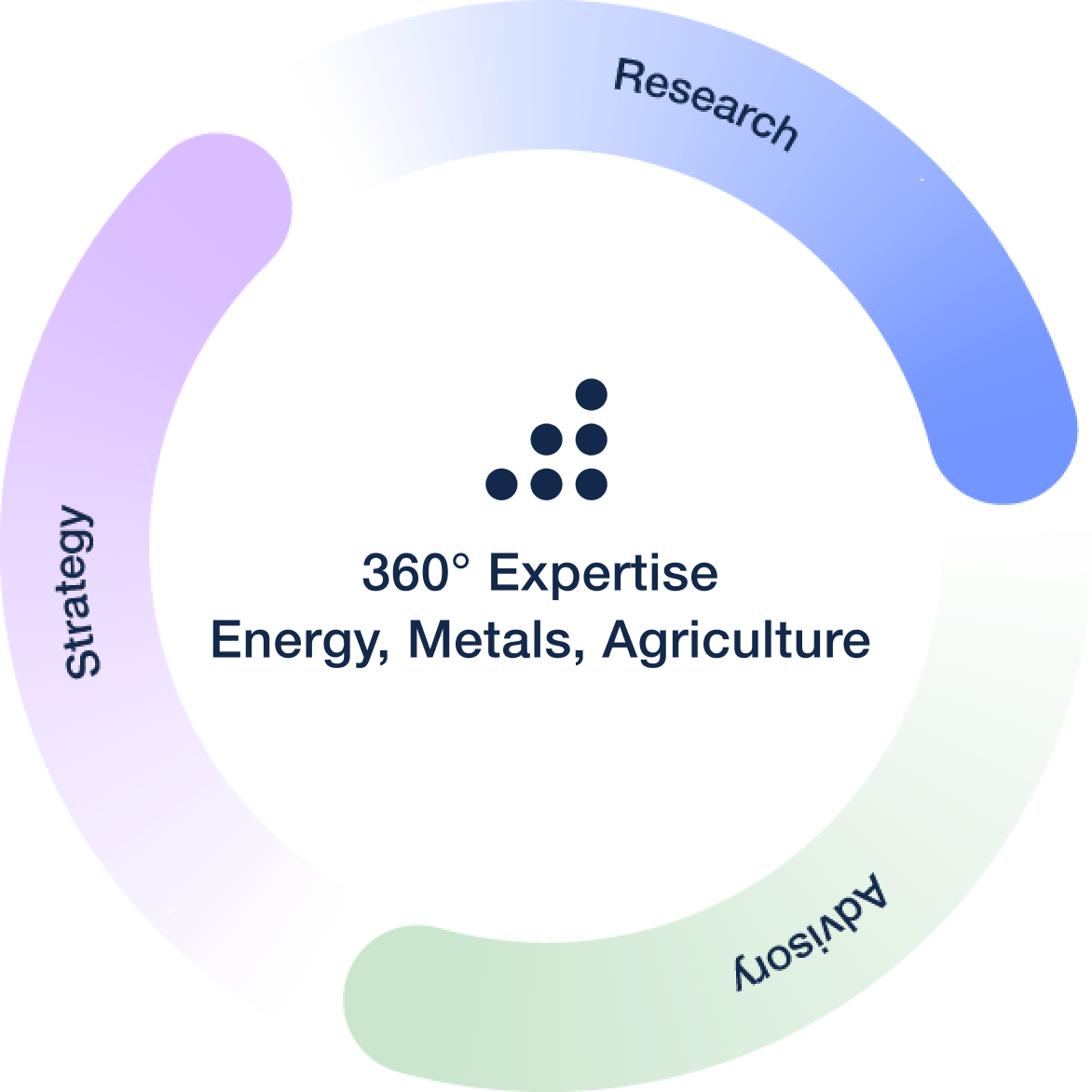

Energy, metals, agriculture: No matter how advanced our society becomes, we remain bound to the material reality of finite resources and an ever-growing dependence on energy. Commodity investments can optimise your portfolio’s risk and return through diversification and inflation protection. Since 2003, we have provided professional investors with 360° commodities expertise – from research and advisory to fully customised solutions for developing their own commodity strategies.

Lunch-Event

The Commodity Supercycle – Perspectives from Gold and Silver Producers

In 2025, precious metals have re-emerged as core strategic assets rather than mere hedges. During this Investor Lunch, the Commodities Competence Center of Picard Angst will highlight how institutional investors can benefit from the global resource transformation.

We are pleased to welcome Darren Hall, CEO of Equinox Gold (Market Cap USD 8.5 bn), a leading Canadian gold producer with multiple operations across the Americas, and Benoit La Salle, President & CEO of Aya Gold & Silver (Market Cap USD 2.5 bn), a dynamic mining company focused on silver production in Morocco. They will share exclusive insights from the perspective of two exciting mining ventures shaping the future of precious metals.

Pablo Gonzalez

Senior Portfolio Manager Commodities

Commodities

Competence Center

Commodity Markets, Politics, and Regulation

We analyse market trends, supply and demand dynamics, and macroeconomic drivers to provide a robust foundation for investment decisions, risk assessments, and thematic positioning. Stay informed on all factors influencing commodity prices while benefiting from the insights of our distinguished Commodity Advisory Board.

Highlights

- Proprietary database with key figures for over 500 commodity companies

- In-house risk factor models for individual commodities and sectors

- Proprietary geopolitical risk model and monitoring

- Strategic input from our Commodity Advisory Board

- Regular publications on commodity market trends

- Sector-specific analyses in energy, metals, and agriculture

Tailored to Your Portfolio Context

Based on a comprehensive portfolio analysis, we help professional investors make informed commodity investment decisions. We provide bespoke recommendations for optimising your portfolio with commodities, considering investment horizon, overall risk parameters, investment guidelines, regulatory requirements, instruments, and market conditions.

Highlights

- Portfolio screening of commodity allocations and exposures

- Regulatory compliance review (BVV2, Solvency II, ESG)

- Resilience assessments and stress testing

- Market scenario modelling

- Tailored thematic and product recommendations

Systematic and Consistent Solutions

Transparency, repeatability, and maximum value creation: With Picard Angst, you benefit from a proven systematic investment approach across all instruments. Rely on our established commodity equity and commodity direct investment strategies, or opt for bespoke solutions with structured products, actively managed certificates, or hybrid multi-asset solutions.

Highlights

- Commodity Direct Investments: Picard Angst Adaptive Roll

- Commodity Equities: Picard Angst Alpha Scorecard

- Structured Products: Thematic baskets

- AMCs: Actively managed certificates

- Multi-Asset: Bespoke hybrid solutions

Commodity Equities: Alpha Scorecard

We continuously collect financial and operational data on over 500 commodity companies. Using our Alpha Scorecard, we analyse and assess over 100 qualitative and quantitative factors (financial strength, sustainability, operational performance) to identify leading companies in energy, industrial metals, and precious metals. Investors can participate via our funds, certificates, or tailored structured products.

Commodity Direct Investments: Ideal Portfolio Diversifier and Inflation Hedge

In contrast to commodity equities, direct investments in commodities exhibit a low average correlation to traditional asset classes such as equities and bonds. This makes them an exceptionally efficient diversifier for balanced, mixed investment portfolios. As a defensive attribute, commodities also offer a uniquely high sensitivity to inflation compared with other asset classes. In addition, among alternative investments, commodities stand out for their high liquidity.

However digital our future may be, the demand for increasingly scarce raw materials will continue to grow.

Trust in us