Energy Transition – A Catalyst for Commodity Investments

The energy transition is triggering an unprecedented surge in demand for raw materials. Discover how systematic commodity strategies can capture the opportunities created by this fundamental transformation. Leverage our expertise now, the timing is compelling.

Lunch-Event

The Commodity Supercycle – Perspectives from Gold and Silver Producers

In 2025, precious metals have re-emerged as core strategic assets rather than mere hedges. During this Investor Lunch, the Commodities Competence Center of Picard Angst will highlight how institutional investors can benefit from the global resource transformation.

We are pleased to welcome Darren Hall, CEO of Equinox Gold (Market Cap USD 8.5 bn), a leading Canadian gold producer with multiple operations across the Americas, and Benoit La Salle, President & CEO of Aya Gold & Silver (Market Cap USD 2.5 bn), a dynamic mining company focused on silver production in Morocco. They will share exclusive insights from the perspective of two exciting mining ventures shaping the future of precious metals.

Pablo Gonzalez

Senior Portfolio Manager Commodities

Insights

Where the Investment Opportunities Lie

The global energy transition is reshaping commodity markets and energy infrastructure at unparalleled speed. Ambitious climate targets create new bottlenecks, capital requirements and regulatory frameworks.

Picard Angst pinpoints the megatrend’s key opportunities, from electrification and evolving energy systems to the growing importance of alternative fuels and presents concrete investment solutions for institutional investors.

Electrification Creates Supply Deficits

Shifts in the energy mix are driving up demand for critical metals such as copper, nickel, lithium and cobalt—vital for wind and solar power generation as well as energy storage.

A typical electric vehicle contains up to six times more copper than a conventional car. Photovoltaic and wind installations also require up to twelve times more metal per kilowatt‑hour generated than fossil‑fuel power plants. At the same time, new mining projects take an average of seven to ten years to begin production, a critical delay given the accelerating demand.

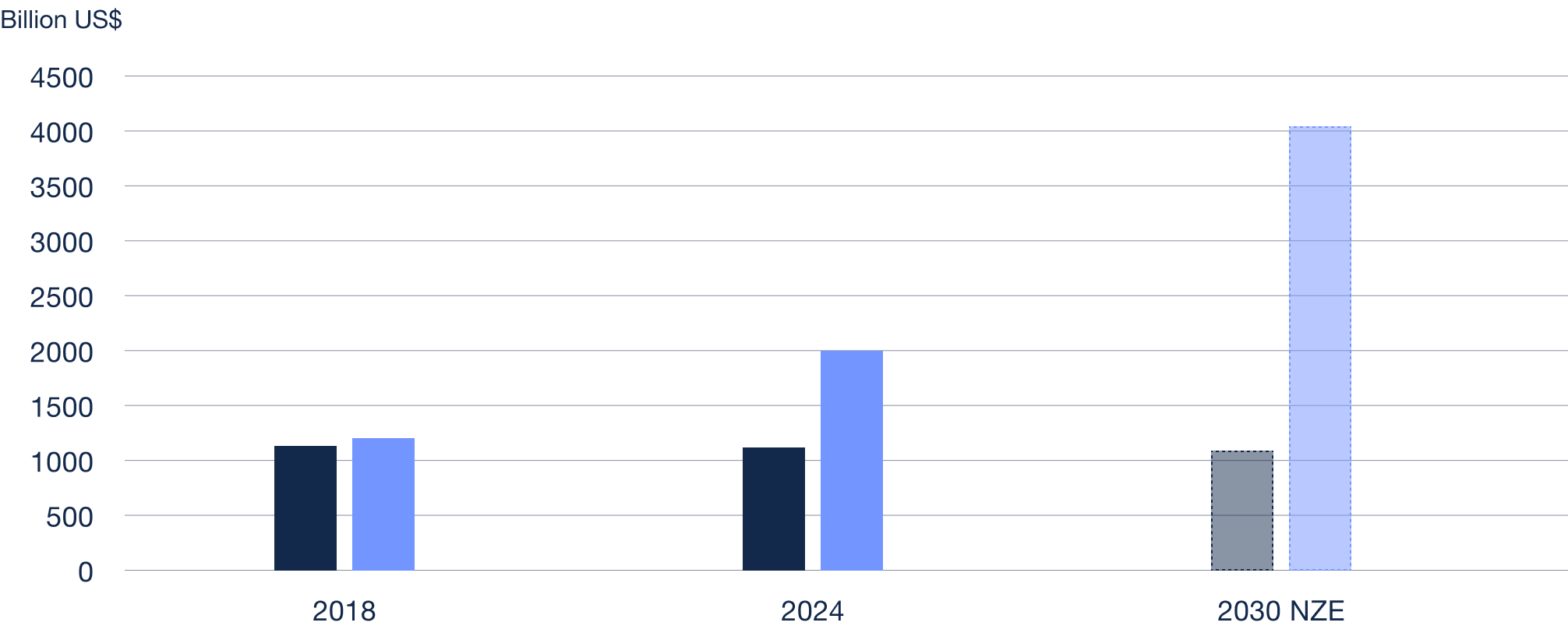

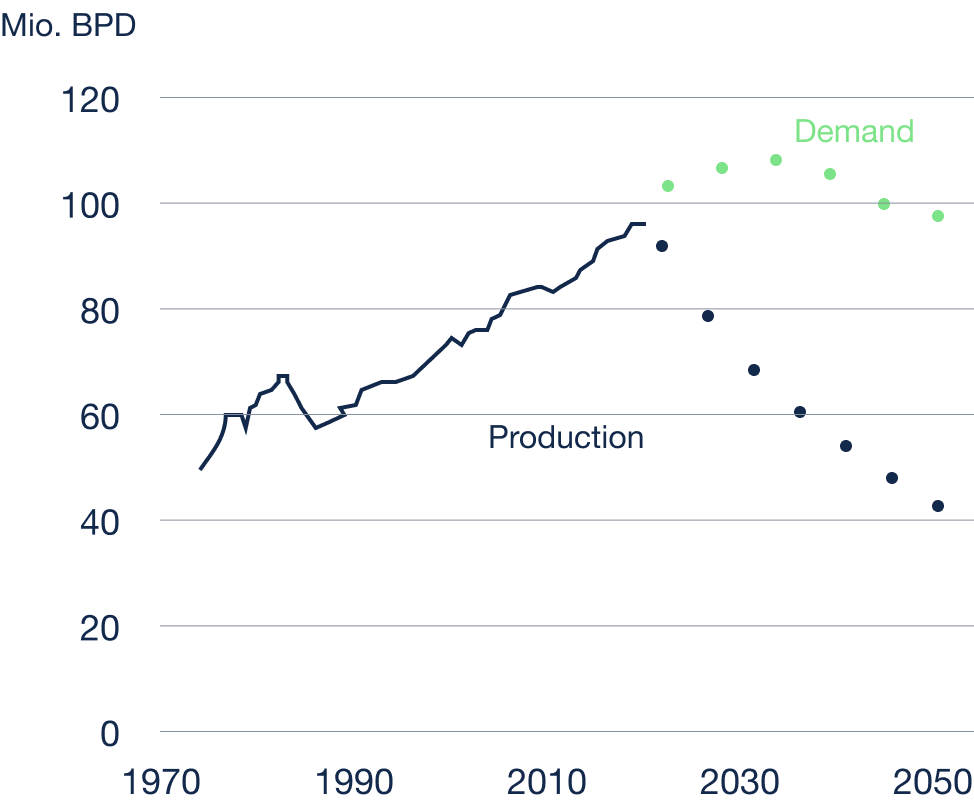

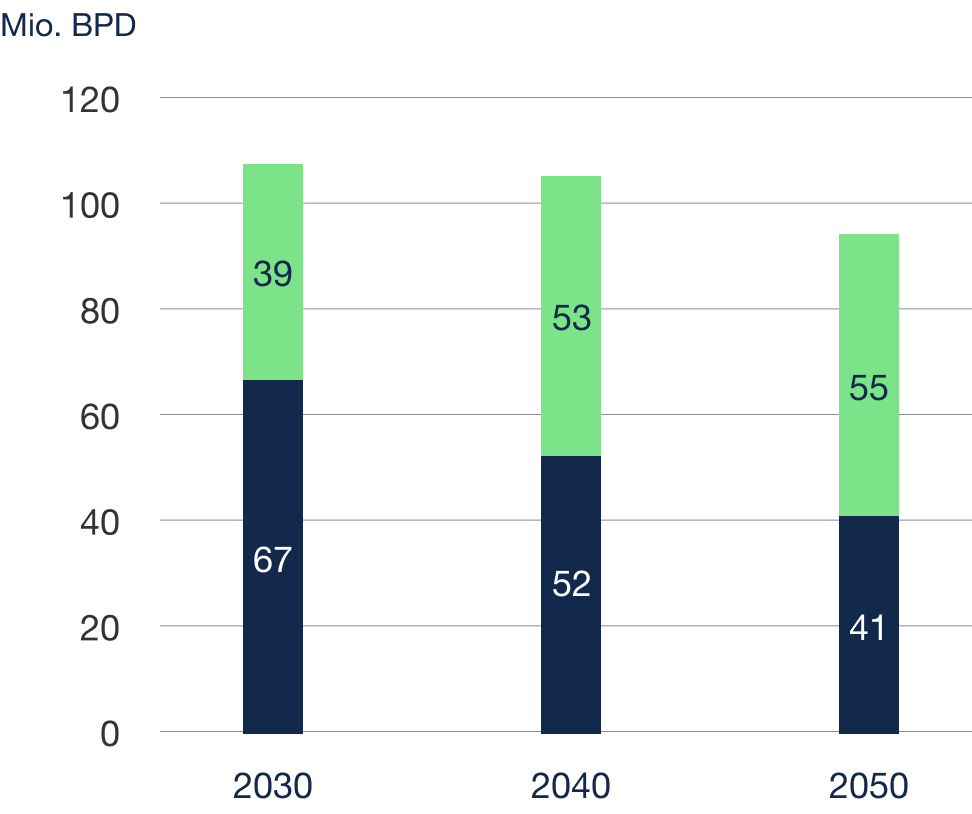

Fossil‑Fuel Scarcity—Despite Falling Demand

While decarbonization gradually shifts the energy mix toward renewables, fossil fuels will remain essential for years. From 2030 onward, existing oil fields will no longer meet demand, new production will be needed.

Global oil‑industry investment in exploration and infrastructure has fallen for years. Political volatility in producing regions is rising. Emerging‑market energy demand continues to grow. Together, this blend of structural decline and geopolitical risk makes fossil energy a tactical investment factor.

Looming Shortages

Decline in output from existing oil fields; fossil fuels still dominate the global mix.

Source: Bloomberg LP

-

Existing production

-

New production needed

In Brief

- 40% of crude supply comes from politically unstable regions

- OPEC controls ~40% of global oil production

- Crisis‑driven price swings of ±5–10%

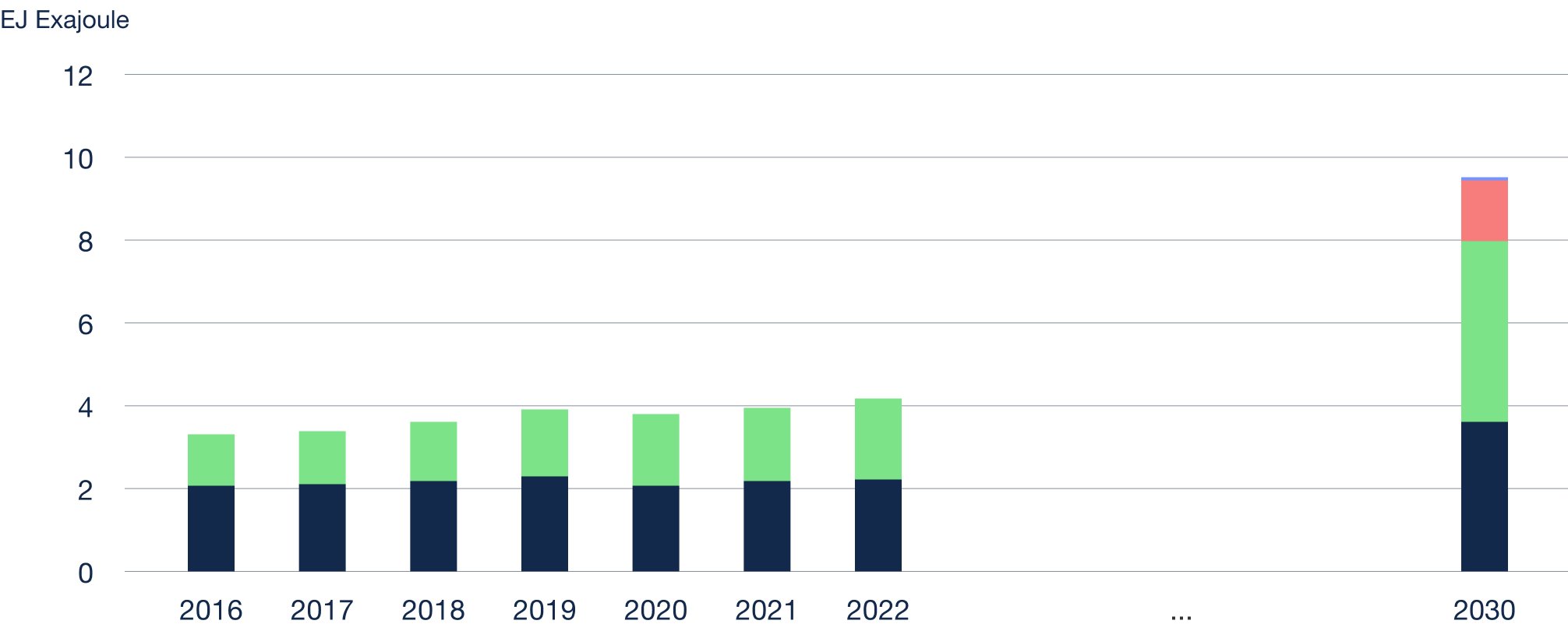

Demand for Biofuels to Double

Meeting climate goals will more than double global biofuel demand by 2030. These fuels—primarily based on sugar, corn and grains—are increasingly regulated.

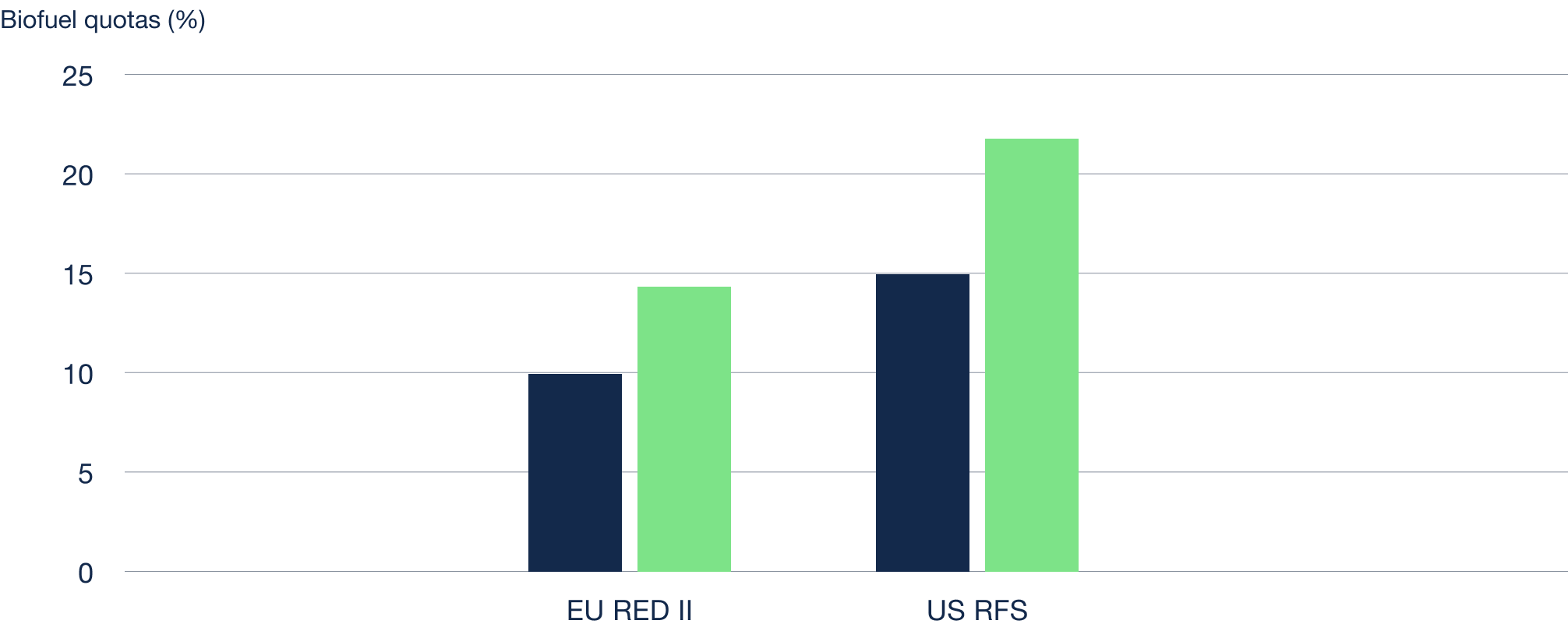

Directive RED II in the EU and the U.S. Renewable Fuel Standard mandate sustainable biofuels. Minimum quotas secure long‑term demand and provide institutional investors with stable market conditions and planning certainty.

In Brief

- EU RED II: 14% biofuel share mandatory by 2030

- U.S. RFS: annual minimum quotas since 2007

- 50+ countries worldwide with biofuel mandates

Our investment ideas

Video

For nearly two decades our commodity strategies have consistently outperformed established benchmarks.

Trust in us