Your Solution Partner for Structured Products

For over 20 years, we have supported institutional clients such as pension funds, asset managers, banks, and family offices in the efficient and independent structuring of investment solutions – with in-depth expertise, lean processes, and a broad product universe covering structured products, digital assets, and derivatives.

Webinar

Crypto Opportunities for Institutional Investors. A Practical Approach with AMCs

Many institutional investors, including pension funds, have increasingly engaged with the topic of cryptocurrencies. The pressure to diversify and tap into new investment opportunities has grown, while regulatory requirements and operational complexity have posed significant challenges. Using the example of an institutional investor who allocated 3% of total assets to a crypto AMC, we presented proven, regulation-compliant, and client-specific investment solutions.

Bora Sentürk

Senior Client Advisor Market Switzerland

Structuring & Digital Investment Solutions

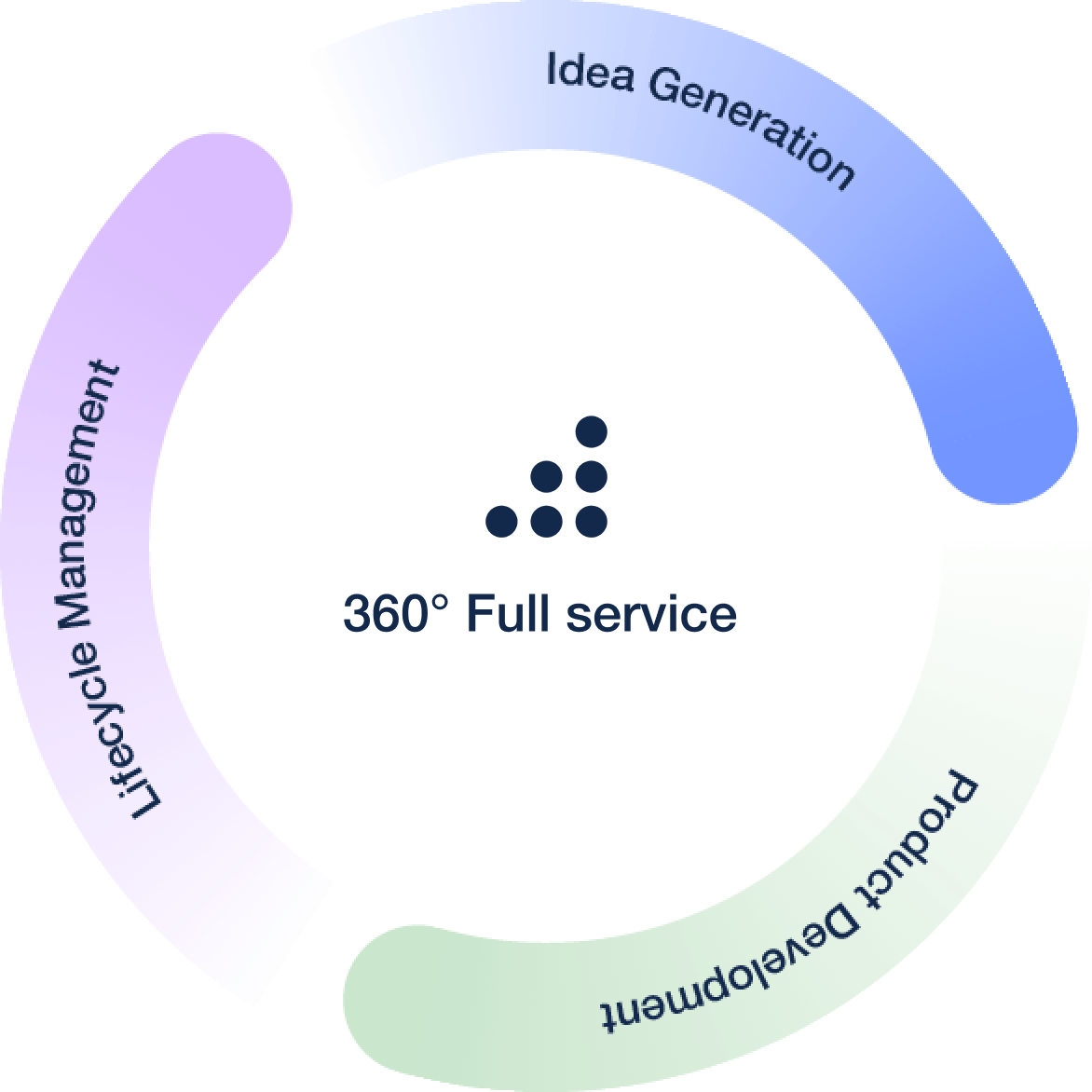

360° expertise for structured products, AMCs, and digital assets – from idea generation to lifecycle management.

From Market Trend to Product Concept

In a structured advisory meeting, we gather all relevant information regarding your objectives and framework conditions. Based on your market outlook and risk profile, we develop initial, fully tailored product ideas and scenarios for you. You then receive a draft term sheet, including indicative pricing.

With our multi-issuer platform, you can design, compare, test, and price your ideas in seconds. Benefit from a high degree of customisation, a vast universe of underlying assets, all product structures, and independent access to over 20 issuers. Products created on the platform can be integrated directly into your portfolio within the same workflow.

Services

- Definition of objectives, return/risk profile, volume

- Investment strategy and solution

- Draft term sheet and indicative pricing

- Independent multi-issuer platform

Structuring, Optimisation, and Terms Negotiation

In the second phase, our financial engineering team develops and structures your product in detail, with dedicated ESG integration support. You receive the final term sheet, KIDs, and – if required – a white-labelled product flyer as marketing support.

Services

- Analysis, structuring, optimisation

- Negotiation of terms with issuers

- ESG filter options, document review

- Final term sheets

- White-labelled product flyer on request

Real-Time Monitoring, Reporting, and Rollover Support

After product finalisation, we coordinate settlement with custodian banks. Through our digital lifecycle platform, you gain a transparent overview of your portfolio and products. We monitor observations, corporate actions, coupon payments, early and final redemptions, and support you in rolling over into successor products. Tailored reporting and coordination of secondary market transactions are included.

Services

- Settlement coordination

- Access to the digital lifecycle platform

- Monitoring and rollover support

- Reporting

- Secondary market transaction coordination

Current Offers and Ideas

Structured products, actively managed certificates, and regulated access to digital assets via AMCs or wrapper solutions: We tailor investment ideas to your exact needs.

Your Benefits

Independent Advice

Broad issuer network – solutions designed solely to meet your needs.

Tailored Engineering

From classic barrier reverse convertibles to rule-based AMCs.

Digital & Regulatory Security

Swiss-based – tax-optimised, 100% transparent.

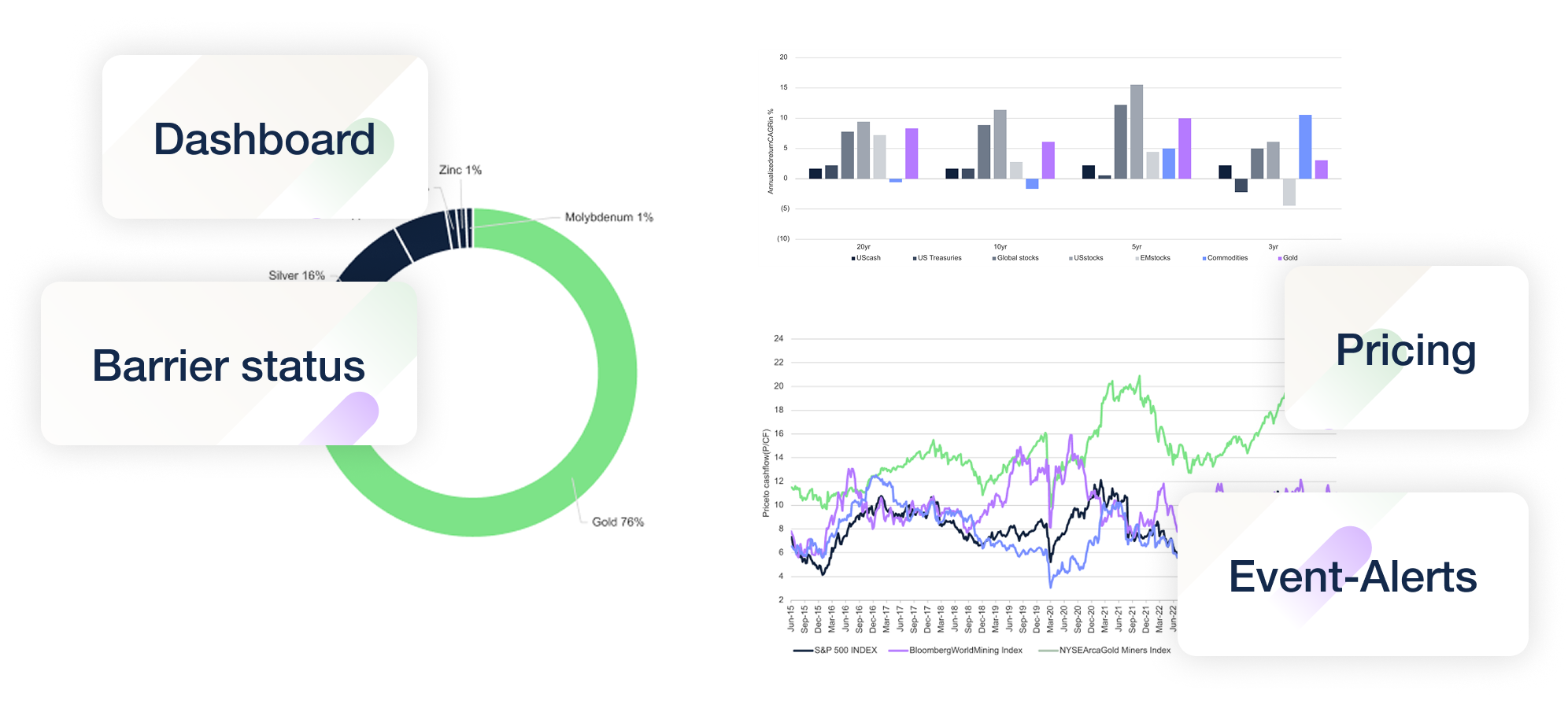

Digital Lifecycle Platform

Our digital lifecycle platform keeps you in control of your structured products and digital assets at all times. View holdings, distances to barriers and autocall levels, upcoming coupon payments, and all product documents in one place. Generate portfolio and product overviews as PDFs on demand.

With tailored investment solutions – from classic structured products to digital assets – we give institutional investors access to individual solutions across all market phases.

Trust in us